Fujita Kanko (Price Discovery)

| Securities Code |

| TYO:9722 |

| Market Capitalization |

| 48,219 million yen |

| Industry |

| Service |

Profile

Founded in 1946, Fujita Kanko operates hotels, wedding and banquet facilities, restaurants, resorts, and leisure facilities in Japan. It operates the prestigious banquet hall Chinzanso, Hotel Chinzanso Tokyo, Washington Hotel for business and Hakone Resort. It also provides management services for resorts and urban condominiums and property management services for land for building villas. Sales mix % (OPM%) by segment: WHG (accommodation) 47 (-16), Luxury & Banquet 35 (0), Resort 13 (-8), Other 5 (-9) (FY12/2022)

Stock Hunter’s View

Inbound tourism is gaining momentum. Re-opening of the “Face of Hakone” this summer.

Fujita Kanko, which operates accommodation businesses throughout Japan, including Hotel Chinzanso Tokyo, is an inbound-related company to watch. The Japan National Tourism Organisation (JNTO) announced on 19 June that the number of foreign visitors to Japan in June was 2,073,300 (estimate), exceeding 2 million for the first time in three and a half years. This is a recovery of 72% compared to the same month in 2019 before the pandemic disaster.

The good earnings performance in 1Q (Jan-Mar) has led to a revision of the full-year operating profit forecast from 400 million yen to 3.7 billion yen (compared to a loss of over 4 billion yen in the previous year). The main WHG (hotels for business and tourism) business achieved a significant increase in revenue, up 97% YoY, due to a sharp recovery in inbound demand, mainly in Tokyo. The number of inbound guests also confirmed a strong start, with the number of inbound guests exceeding that of 2019 in the single month of March. The luxury banqueting business is also on track to return to operating profitability, with a recovery in using the accommodation and banqueting departments.

Against this backdrop, the Hakone Hotel Kowakuen, one of Hakone’s leading accommodation facilities, re-opened on 12 July after five and a half years following a significant renovation. 2Q results are scheduled to be announced on 10 August.

Investor’s View

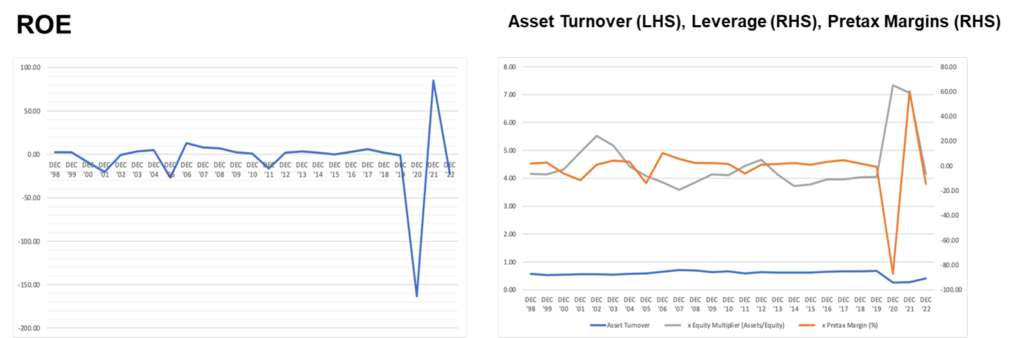

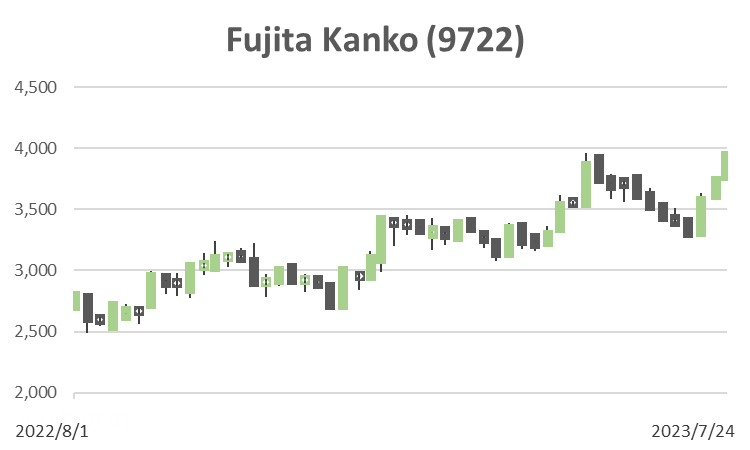

Speculative BUY: The recovery of tourism demand in Japan is strong, and earnings should be solid in the near term. ROE averaged a thin 0.25% in the ten years before COVID-19. One cannot believe that there has been a structural improvement that would lift poor secular ROE.

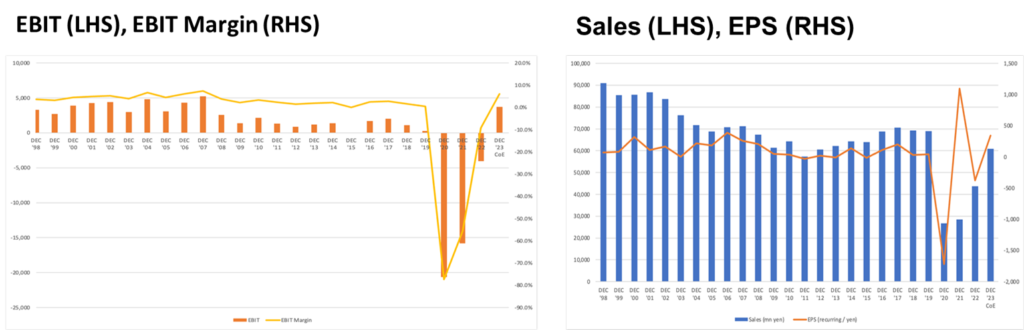

The share price has performed strongly since 2021, up 31% even since the beginning of the year. The sharp recovery from the large deficit caused by COVID-19 has been factored in. Against last year’s loss, management’s forecast EBIT for FY2023 is 3.7 billion yen. This is the highest figure since 2007 when it was 5.2 billion yen.

Recovery from the management crisis due to the pandemic disease is impressive

Fujita Kanko is a long-established company with a history of nearly 80 years. But in 2020, it lost 95% of its equity capital due to the bottom-line deficit of 22.4 billion yen, and its equity ratio fell to 1.2%. Although it avoided insolvency, it was plunged into an unprecedented business crisis. However, in 2021, through asset sales and a third-party capital increase, the company restored its equity ratio to 25.4%. In the meantime, all conceivable cost reductions were executed. These included employee furloughs, cutbacks in executive remuneration, reductions in employee salaries, bringing outsourced work in-house and reviewing contracts, negotiating rent reductions, reviewing investment plans and controlling other costs such as advertising and promotion costs.

Costs should soon normalise

The current demand for tourism in Japan is extremely strong, and earnings are expected to be upbeat in the near term. In the short term, therefore, Fujita Kanko is an interesting investment. However, in the long term, the business is characterised by high costs and low profit margins, which has not changed much after COVID-19. As the company’s utilisation rates normalise, costs should do so with a delay. The current high EBIT margin should be seen as a result of costs not normalising as yet.

Secular ROE remains significantly low

The company’s ROE averaged only 0.25% over ten years to 2019 before the pandemic disease. This is due to low asset turnover (0.58) and low pre-tax margins (0.96). High leverage (4.1) compensates for these, but the return on capital is far from satisfying investors. The recovery from COVID-19 has been impressive, but it looks unlikely that the secular ROE, which is way too low for investors, will improve.