Genki Sushi (Price Discovery)

| Securities Code |

| TYO:9828 |

| Market Capitalization |

| 49,567 million yen |

| Industry |

| Retail trade |

Profile

Genki Sushi operates a sushi chain. The company operates directly managed sushi-go-round restaurants named Uobei, Genki Sushi and Senryo. The franchise business recruits and provides management guidance to overseas franchisees. The largest shareholder is Shinmei (unlisted), a rice wholesaler with a 40.5% stake.

Stock Hunter’s View

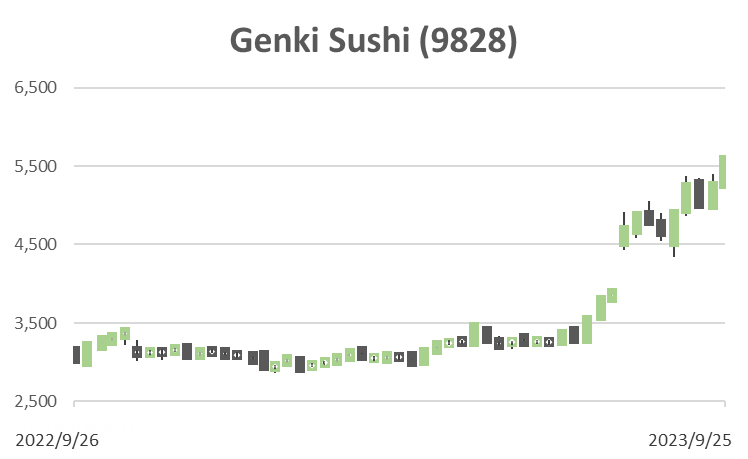

A strong candidate for upward revision; one-for-two stock split at the end of October. Shareholder benefits to be substantially expanded.

Genki Sushi, whose mainstay is the conveyor-belt sushi restaurant Uobei, announced that it will carry out a 1-for-2 stock split at the end of October. The investment unit will be reduced to less than the TSE-recommended 500,000 yen, which is expected to broaden the investor base and improve the shares’ liquidity.

In line with this, the annual dividend is revised from 20 yen to 15 yen a share. The total amount will remain unchanged. On the other hand, the number of shares eligible for the shareholder benefit scheme will remain unchanged after the split, with the number of shares to be held “100 shares or more” to be substantially expanded. In addition, “100 shares or more but less than 200 shares” will be newly included.

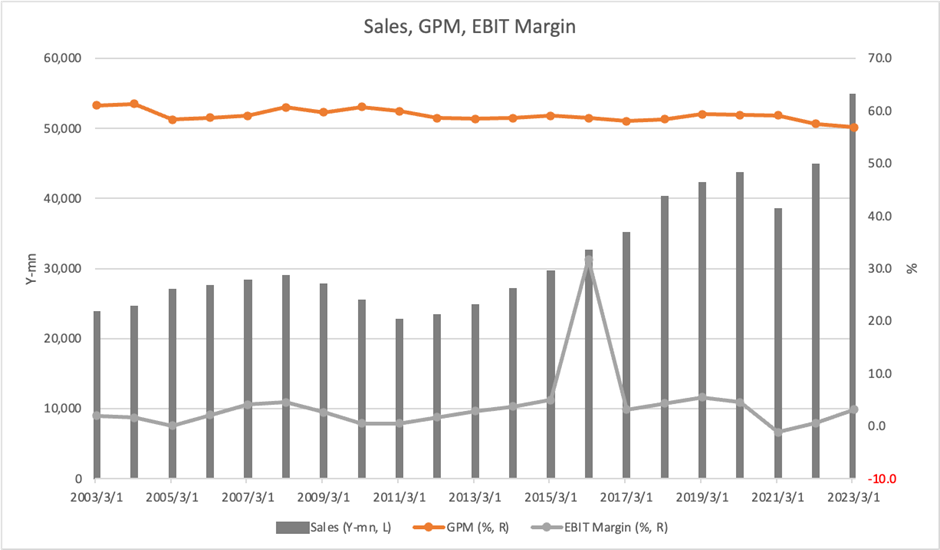

The company’s earnings are strong, and upward revisions are likely during the year. The company’s previously announced 1Q (Apr-Jun) results started with an operating profit of 1.048 billion yen (+94.6% y/y). Progress against the full-year forecast (-16.5% YoY to 1.45 billion yen) reached 72%. Market conditions for some seafood at the Toyosu market have softened, and there are expectations for an improvement in gross profit margins.

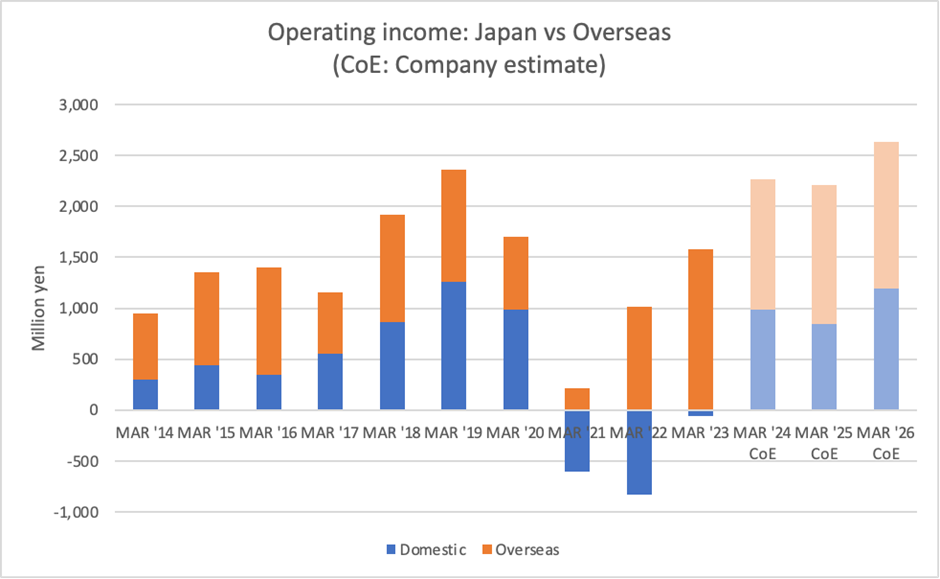

The driving force is Japan, but the overseas business also landed on higher revenues and profits. Royalty income from franchisees increased. The impact of China’s suspension of imports of Japanese seafood on the company’s development of Chinese franchises is expected to be negligible. The company is also strong in the US and the Middle East.

Investor’s View

Medium- to long-term investors are recommended not to chase the share price rally. Return on equity will struggle to expand in the long term. Near-term earnings are priced in.

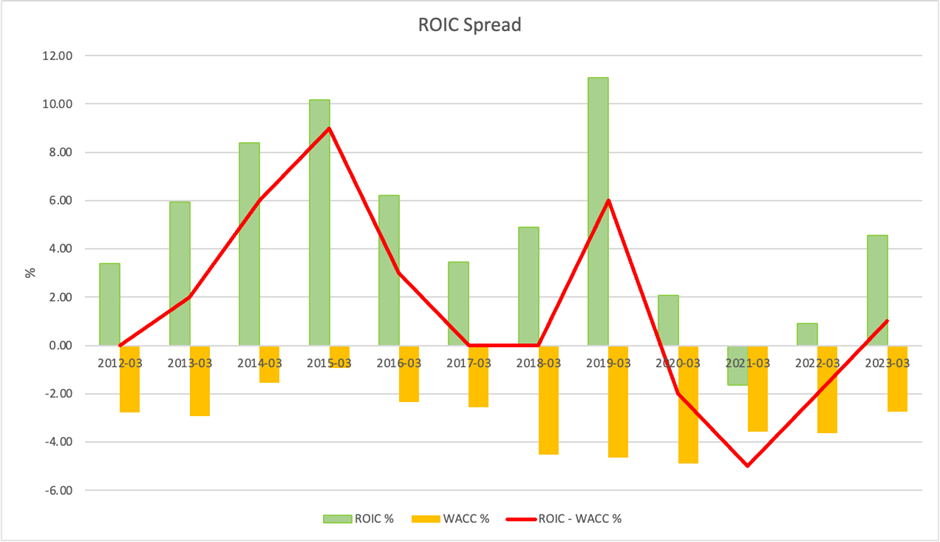

Profitability is recovering rapidly due to the return of customers as the pandemic disease has calmed down. Management is led by Masuo Fujio, the fourth-generation family president of the parent company, Shinmei (unlisted, 3/2022 sales: 372.8 billion yen), which owns 40.5% of the company. Initiatives such as rethinking branding, strengthening human resources, exploring new restaurant formats and increasing service value may eventually produce interesting results. President Fujio stated that the company’s forecast for the current financial year is quite conservative. In fact, 1Q results came in very strong, and an upward revision of the full-year forecast looks certain. ROIC spread has turned around and is just above the breakeven point of economic value creation. For now, the momentum of business recovery will be sustained, so further economic value creation. Hence, it is good for the share price. Nevertheless, the share price surge has largely discounted such fundamental recovery and positive earnings expectations. The recovery from COVID-19 should be seen as coming to an end sooner rather than later.

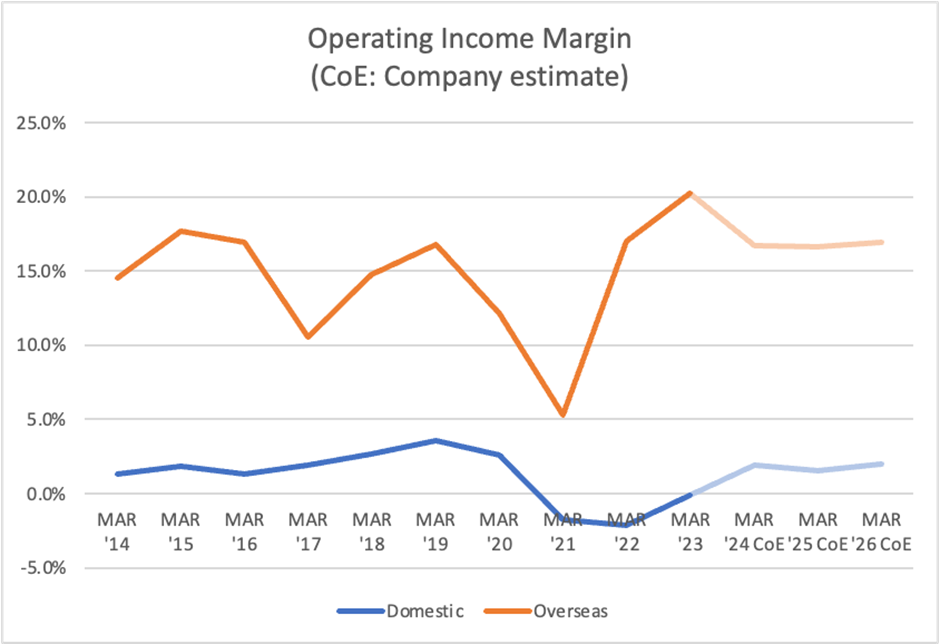

Overseas business attractive, domestic business unattractive

Should investors chase the share price rally? From a long-term perspective, the answer is negative. Overseas business, mainly the franchise business, is attractive, with consistently high profitability and a strong performance supported by the US, which is enjoying a booming economy. On the other hand, the domestic business has yet to escape low profitability, suggesting how intense the competition is.

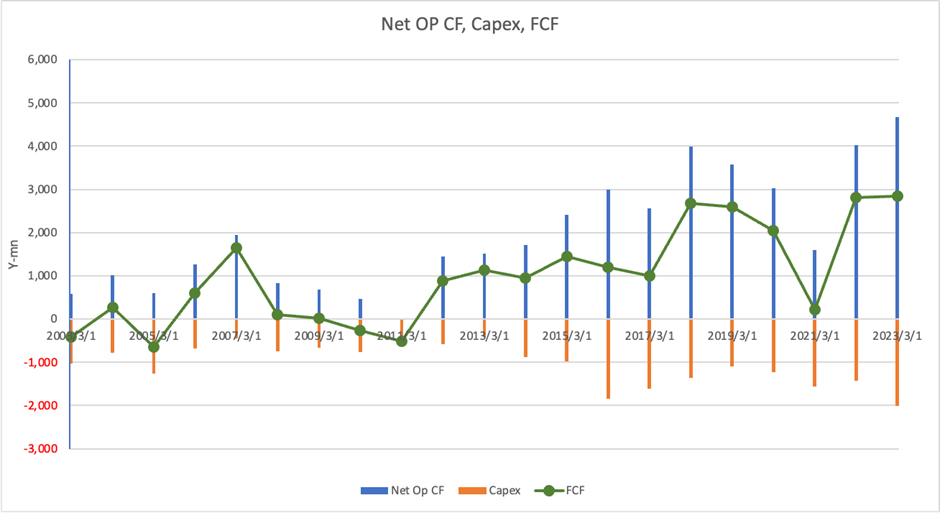

CF is devoted to the domestic business, which runs on a poor return on capital

Capital investment, which is not small, in the range of 1 billion yen to 2 billion yen per year, is devoted to maintaining and expanding the domestic restaurant chain. The company earns good CF but reinvests it in the domestic business, which runs on a low return on capital. This structure does not attract investors.

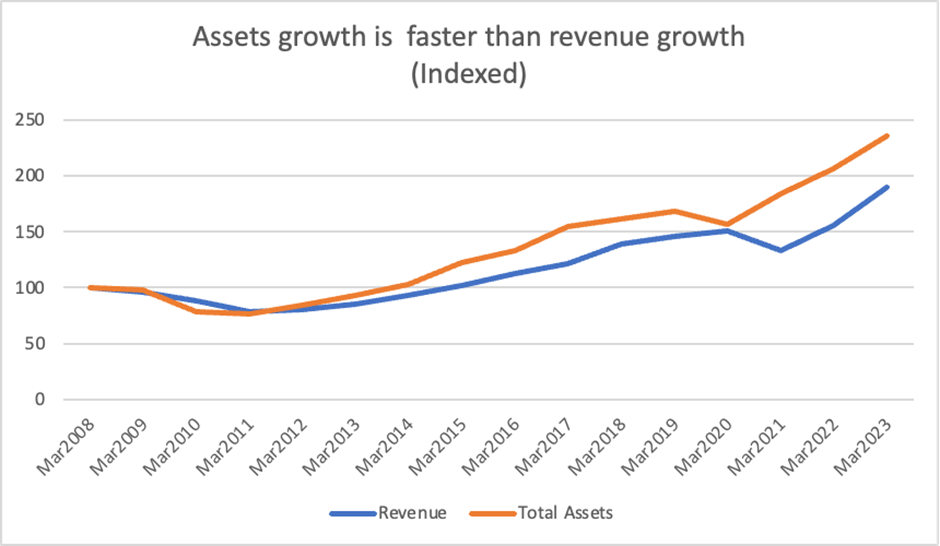

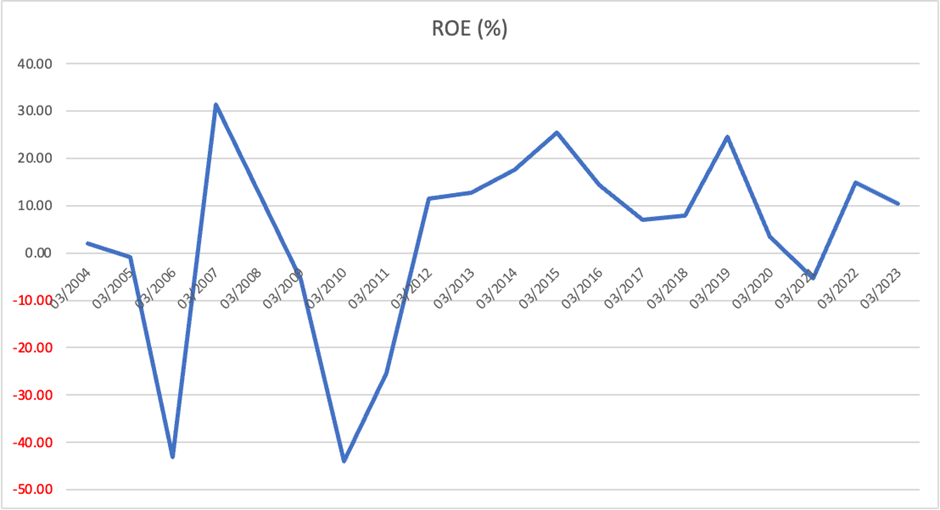

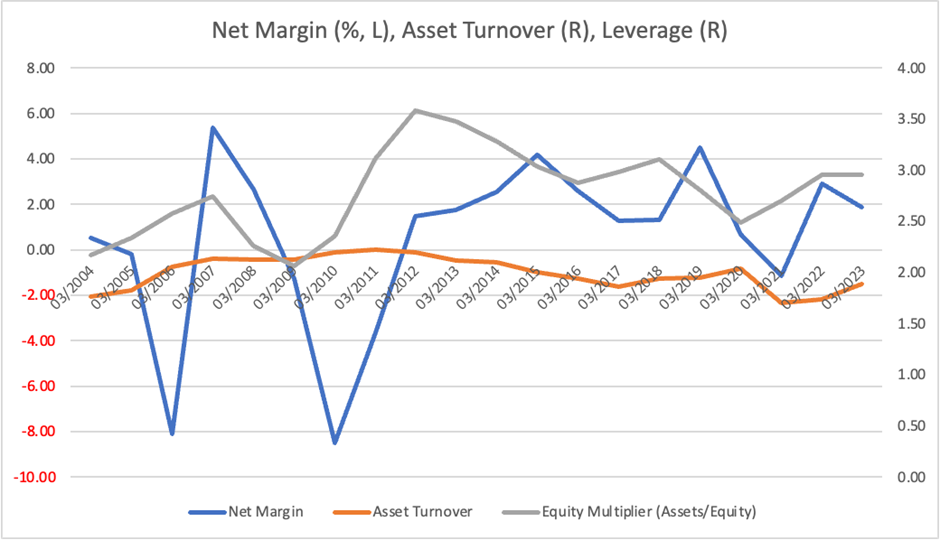

Asset inflation weighs on ROE

Roughly estimated, medium- to long-term ROE is estimated to be range-bound at below 10%. Assets are growing faster than sales. Investment in maintaining the domestic restaurant chain cannot be halted, and BS is expected to continue to expand the more aggressively management expands business scale. Hence, it will be a structural drag on the underlying ROE.