ANYCOLOR (Price Discovery)

Buy

Profile

VTuber Business. Operates NIJISANJI, a VTuber group that performs live-streaming, etc. Founded by Riku Tazumi in May 2017. Sales breakdown: commerce 56%, Live Streaming 20%, Promotion 16%, Event 6%, Others 2% [Overseas] 25%.

| Securities Code |

| TYO:5032 |

| Market Capitalization |

| 196,434 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

One of the two big companies that run the VTuber business. Positive earnings expectations are mounting ahead of 3Q results.

VTuber is an otaku (geek) business that originated in Japan; since its full-fledged launch in 2017, the domestic and international market has grown rapidly, and today, it is not limited to distribution and real events but also includes many collaborations with companies and government agencies.

ANYCOLOR operates the VTuber group “Nijisanji. It is twinned with COVER Corp (TSE 5253) in Japan, which operates the VTuber office “Hololive.

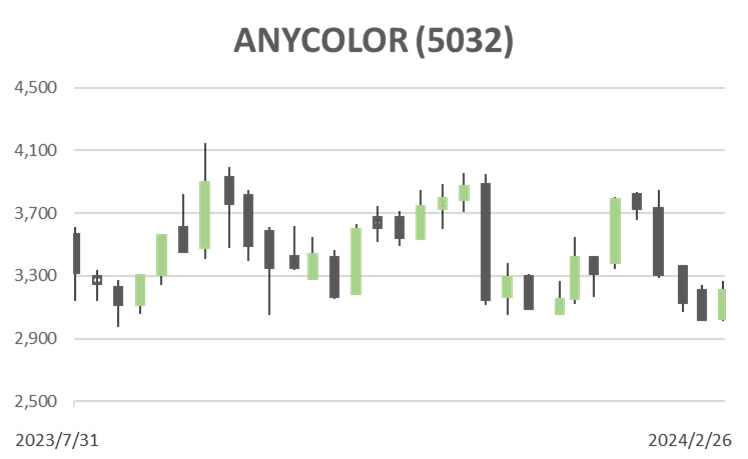

Although there was a significant drop following the recent termination of the contract of Tatsuki Selen, a streamer, the impact of this incident on the company’s performance was negligible.

With the earlier confirmation of good results for the October-December period of COVER Corp, positive expectations are growing for the FY12/2024 third quarter (May 2011-January 2012) results, which are scheduled to be announced on March 14, 2011.

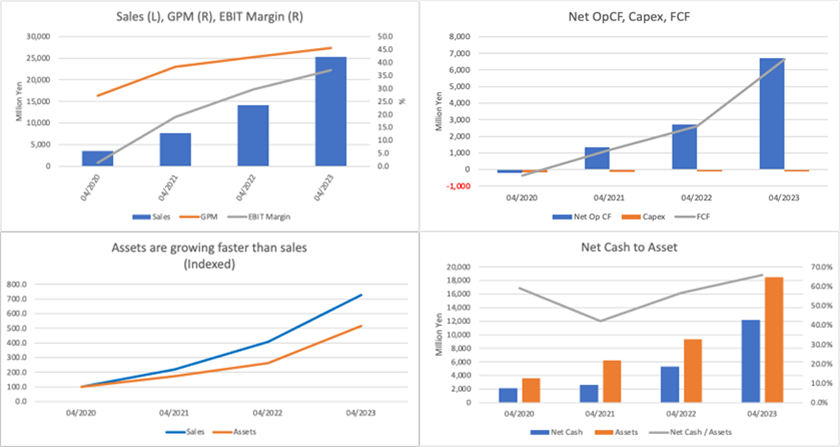

The debut of VTubers and unit development measures are driving growth, and for the current fiscal year ending April 30, 2024, the company plans record-high growth of more than 30% in both sales and profits.

The “Commerce Domain,” which sells VTuber’s original goods and digital products with voice recordings, and the “Promotion Domain,” which handles tie-up advertisements, IP licensing, and media appearances, perform exceptionally well. In the 3Q, the company expects to record revenue from a major festival held in December last year.

Despite the recent troubles with overseas streamers, the company’s focus on overseas expansion remains unchanged. The company intends to work to expand its overseas fan base by actively opening stores at events.

Investor’s View

BUY. The ability to achieve high growth in the midst of a boom is very attractive. We would recommend owning the shares in an equity portfolio.

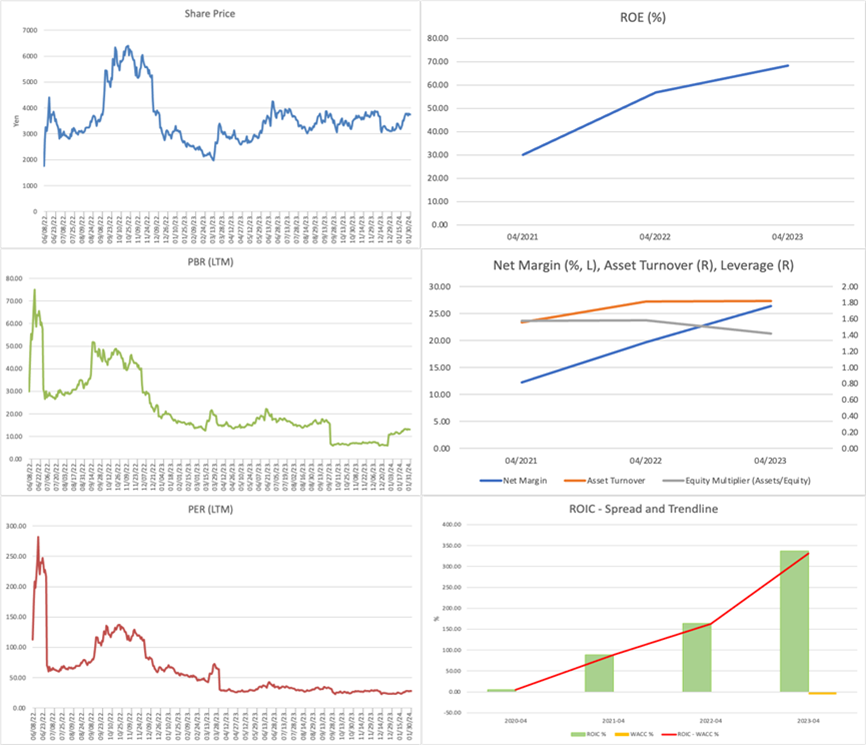

The fundamentals are growing impressively, and the business is very attractive. ROE is close to 70%; the source is the high PL margin: in FY4/2023, the net profit margin was 26% against a GPM of 45%. Sales grew at a 3-year CAGR of +94%. With the current annual sales base exceeding 30 billion yen, the growth rate will slow down but is expected to register +50% in FY3/2024, surpassing the company’s forecast. As to when the market will saturate, it is difficult to find an answer. However, the VTuber culture began to expand rapidly in 2017, and it would make little sense to discuss the market’s demise at this point.

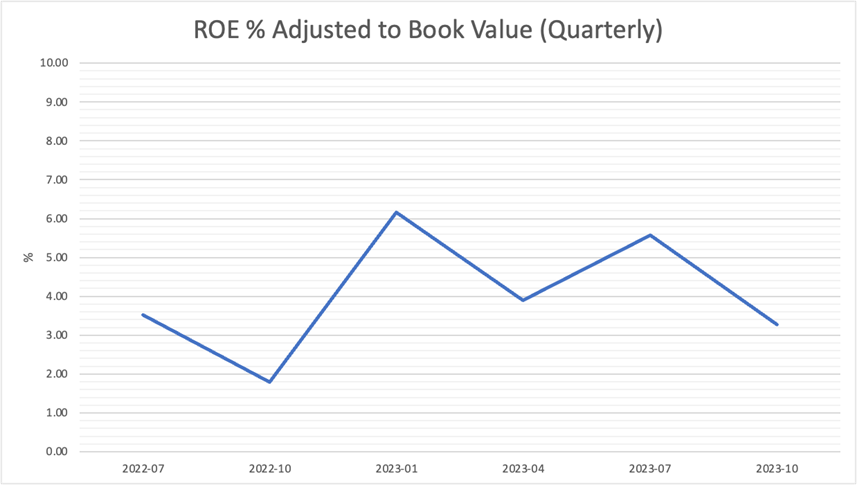

CF generation will be a drag on return on capital, but ROE is still extremely high

CF generation in the business is intense. As a result, cash is building up rapidly, and assets are expanding rapidly. So far, sales growth has outpaced asset growth. However, if management does not use cash effectively and halt the BS expansion, ROE will be significantly pushed downwards. The hunch is that management will not take any drastic measures regarding BS. However, ROE is currently extremely high, and even if it falls to some extent, the focus of investment will be on whether the high level is maintained over the medium to long term.

The shares are worth holding in a portfolio

Valuations have rebounded from the bottom last October, and investor expectations are converging around a PBR of 12x and PER of 24x. With a PBR-adjusted ROE of around 3-5%, below the market average, the shares are likely to have discounted reasonably high expectations of investors. The market’s long-term is difficult to predict, and barriers to entry are expected to be low. However, the company’s ability to achieve high growth ahead of competitors in the midst of an unprecedented boom is extremely attractive. Valuations are not prohibitively high, and ANYCOLOR is a value to hold in an equity portfolio.