Itoki (Company note – Basic)

| Share price (5/8) | ¥1,871 | Dividend Yield (24/12 CE) | 2.77 % |

| 52weeks high/low | ¥2,200/756 | ROE(TTM) | 11.3 % |

| Avg Vol (3 month) | 683 thou shrs | Operating margin (TTM) | 6.4 % |

| Market Cap | ¥99.8 bn | Beta (5Y Monthly) | 1.56 |

| Enterprise Value | ¥81.7 bn | Shares Outstanding | 49.100 mn shrs |

| PER (24/12 CE) | 12.1 X | Listed market | TSE Prime section |

| PBR (23/12 act) | 1.54 X |

| Click here for the PDF version of this page |

| PDF Version |

Designing tomorrow’s ‘work’.

Office DX Company

Summary

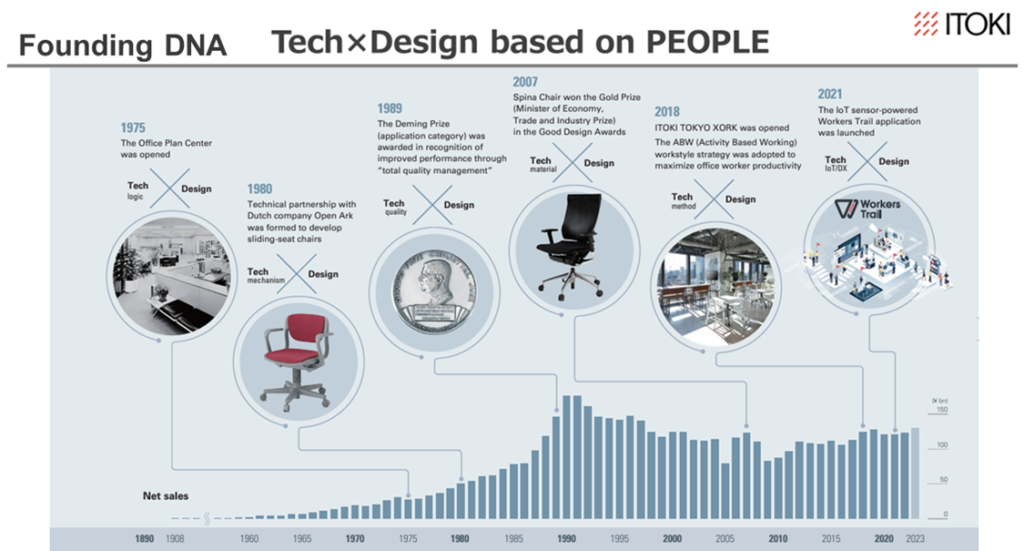

◇Itoki is one of the leading office furniture companies, founded in Osaka in 1890. It is characterized by its high design quality and integrated manufacturing and sales system. Its mission statement is “We Design Tomorrow. We Design WORK-Style.” The company advocates Office 3.0, the DX of the office. It promotes the manufacture and sale of office furniture and the provision of comprehensive services to support the improvement of office productivity.

◇President Koji Minato’s leadership and improvement in performance and corporate value: Under President Koji Minato, who has been at the helm as President and Representative Director since March 2022, the company’s profitability has improved markedly, and the share price has also appreciated this. Expectations are high for his future skills.

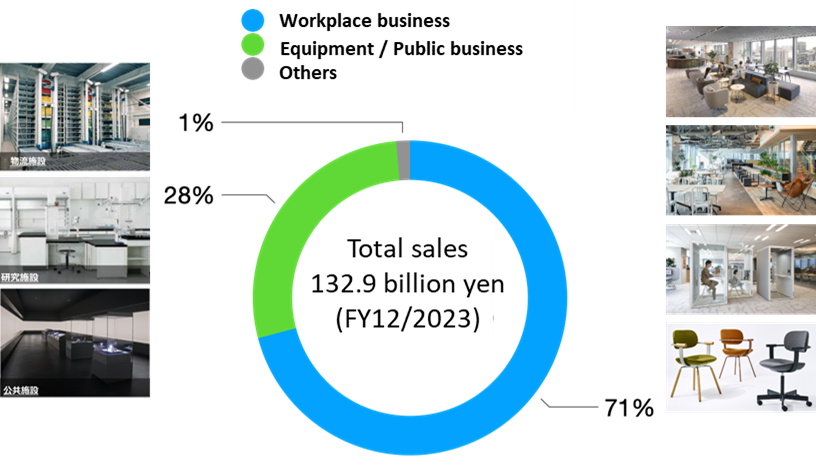

◇Business overview: the leading businesses are Workplace business and Equipment / Public business.

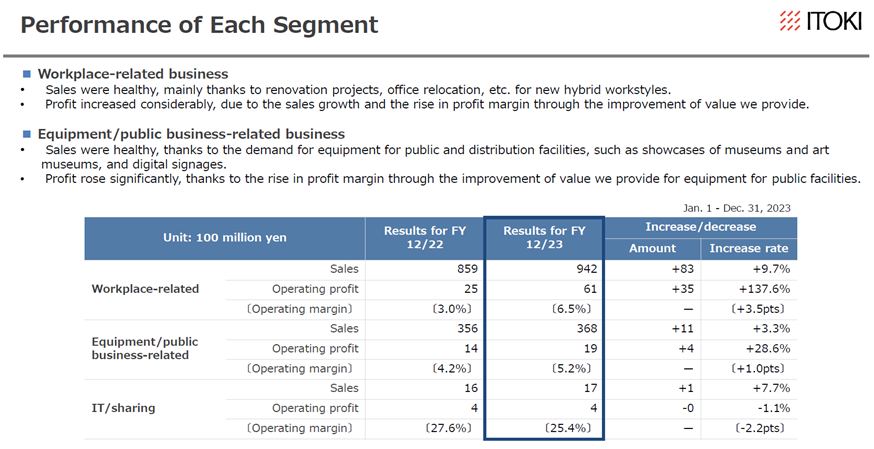

◇Workplace business: It provides services such as manufacturing and selling office furniture, office repairs, assembly and construction, office space design, and project management for office relocation. It is adding value by strengthening its proposals and consulting services to improve office productivity and will promote Office 3.0, which uses data to provide office operational support. In FY12/2023, sales were 94.2 billion yen, operating profit was 6.1 billion yen, and operating profit margin was 6.5%.

◇Equipment / Public business: It provides logistics solutions such as warehousing and automated logistics system equipment, equipment for research facilities, and environmental and space construction for public facilities. No. 1 supplier of shuttle-type automated warehouses. FY12/2023 sales: 36.8 billion yen, operating profit: 1.9 billion yen, operating profit margin: 5.2%.

◇FY12/2023: the results of the reforms kicked in: In FY12/2023, sales reached 132.9 billion yen (+8% YoY) and operating profit 8.5 billion yen (+86% YoY), with sales, operating profit, recurring profit and net profit all reaching record highs. This was due to a steady build-up of renewal projects and office relocations “with an emphasis on profit”.

◇New medium-term management plan “RISE TO GROWTH 2006”: aiming to move into a ‘highly profitable phase’: The new medium-term management plan announced by the company in February 2024 positions the period from 2024 to 2026 as a ‘highly profitable phase’ to enhance sustainable growth potential. The company aims to maximise its business value by combining sales of goods and services on a consolidated basis in response to the growing need to improve productivity in offices, the DX-isation of offices and the IoT-isation of office equipment. More precisely, it consists of the vital strategy ‘7 Flags’ based on the concept of ‘Tech x Design based on PEOPLE’ and the ESG strategy. The financial targets are sales of 150 billion yen, operating profit of 14 billion yen, operating profit margin of 9% and ROE of 15% (> estimated cost of capital of 9-10%) in FY12/2026. The company is also committed to reducing the cost of capital and fully meeting today’s demands of the stock market to maximise shareholder value and increase PBR.

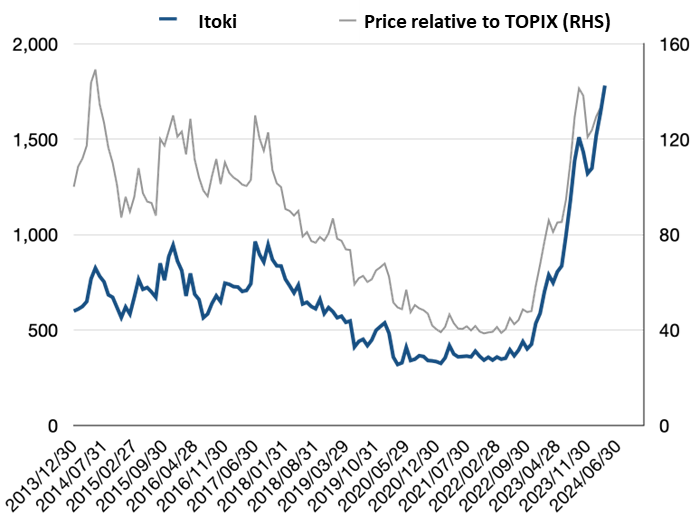

◇Share price trends and highlights: the company’s share price rose from JPY 347 to JPY 1,782 from the end of March 2022, when President Minato took office, to the end of March 2024, with PBR rising from below 1x to around 1.5x. It is believed that the management policy and performance under President Minato’s regime have significantly turned around the investment sentiment concerned about the receding office needs that became apparent with COVID-19 and the company’s past low-profit structure. Going forward, the company’s management is expected to move to the next stage, with a strong need to improve office productivity, an emphasis on profitability on a consolidated basis, increased motivation for employee ingenuity, a higher proportion of sales from selling functions, and the materialisation of new profit opportunities outside of domestic offices. The progress of the medium-term management plan, both quantitatively and qualitatively, will be closely monitored.

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| Company profile | 3 |

| History | 4 |

| Group overview / Production structure / Business diagram | 8 |

| Business overview | 10 |

| Workplace business | 10 |

| Equipment / Public business | 18 |

| Financial results | 20 |

| Full-year results for FY12/2023 | 20 |

| FY12/2024 full-year forecast | 23 |

| Growth strategy | 24 |

| New medium-term management plan RISE To GROWTH 2026 | 24 |

| Stock information, etc. | 27 |

| Share Price Trend | 27 |

| Share price observation | 28 |

| Major shareholders, Shareholding by ownership, Shareholder return policy | 30 |

| Corporate governance and the top management | 31 |

| Sustainability | 34 |

| Financial data | 35 |

Key financial data

| Fiscal Year | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 |

| [Statements of income] | |||||||

| Net sales | 108,684 | 118,700 | 122,174 | 116,210 | 115,839 | 123,324 | 132,985 |

| Gross profit | 38,718 | 41,264 | 41,679 | 41,888 | 41,694 | 45,749 | 52,240 |

| SG&A expenses | 35,761 | 39,339 | 40,776 | 40,089 | 39,158 | 41,167 | 43,717 |

| Operating income | 2,956 | 1,925 | 903 | 1,798 | 2,536 | 4,582 | 8,523 |

| Ordinary income | 3,295 | 2,365 | 945 | 1,881 | 2,437 | 4,177 | 8,555 |

| Net income | 2,402 | 1,722 | -550 | -235 | 1,166 | 5,294 | 5,905 |

| [Balance Sheets] | |||||||

| Current assets | 58,147 | 62,143 | 58,109 | 57,183 | 57,753 | 71,027 | 73,304 |

| Cash and deposits | 19,977 | 16,229 | 17,030 | 18,246 | 17,351 | 26,876 | 24,795 |

| Non-current assets | 44,073 | 46,559 | 49,955 | 47,912 | 46,144 | 44,260 | 44,132 |

| Total assets | 102,221 | 108,703 | 108,778 | 105,096 | 103,898 | 115,288 | 117,437 |

| Total liabilities | 54,894 | 61,210 | 62,944 | 60,906 | 58,822 | 65,377 | 62,437 |

| Total net assets | 47,326 | 47,492 | 45,834 | 44,189 | 45,076 | 49,910 | 54,999 |

| Equity ratio (%) | 46 | 44 | 42 | 42 | 43 | 43 | 47 |

| [Statements of cash flows] | |||||||

| Cash flow from operating activities | 3,565 | 1,384 | 3,586 | 4,561 | 2,774 | 5,804 | 6,321 |

| Cash flow from investing activities | -2,971 | -3,094 | -3,221 | -1,152 | -1,170 | 4,923 | -4,012 |

| Cash flow from financing activities | -706 | -2,463 | 0 | -2,267 | -2,658 | -1,426 | -4,148 |

| Cash and cash equivalents at end of period | 18,571 | 14,540 | 15,494 | 16,697 | 15,797 | 25,420 | 23,664 |

Source: Omega Investment from company materials

Company profile

Itoki is one of the four largest manufacturers of office furniture in Japan. It is a long-established company with a history of more than 130 years since its foundation in 1890.

With a mission statement of “We Design Tomorrow. We Design WORK-Style”, the company not only manufactures and sells office furniture but also provides consulting on working styles and space design, offering the value of creating spaces, environments, and places for workers. The company has long been committed to designing, and its products are renowned for design excellence.

The two business segments are.

Workplace business: mainly manufactures and sells office furniture, but as stated in its mission statement, the company advocates the creation of ‘working environments’ tailored to how customers work. In recent years, the company has actively responded to the needs of a growing number of ways of working, such as working from home and in dispersed locations, in addition to working “collectively” in an office. Moreover, the company provides consulting services and other total solutions.

Main products and services; office furniture (desks and workstations, tables, office and conference chairs, system storage furniture, lockers), manufacture and sale of construction materials for office space construction, interior decoration work, office space design, project management for office relocation, etc., office repair and maintenance services, telework furniture, study furniture.

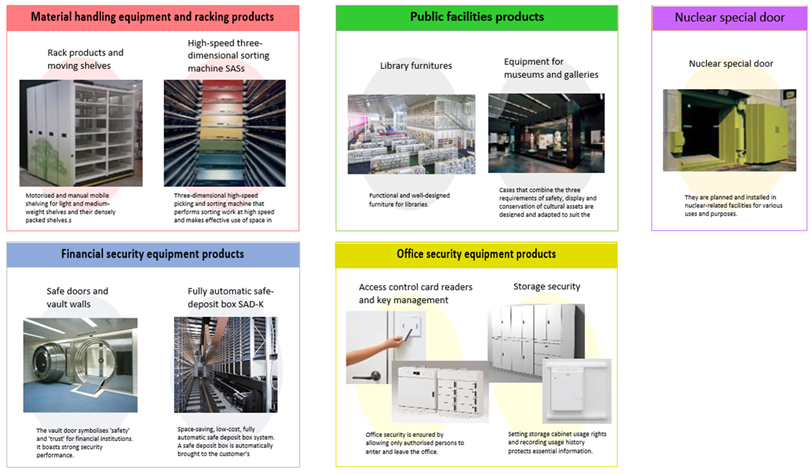

Equipment / Public business: provides logistics-related facilities, which have proliferated in recent years, as well as research facility equipment for pharmaceutical companies, universities and research institutions, and equipment for public facilities.

Main products and services; logistics equipment (shuttle cart automatic storage systems (SAS)), storage shelves, special doors, office security systems, research facility equipment, powder machinery and equipment, environmental and space construction for public facilities, etc.

The composition of sales by region is as follows: Japan, 120,790 million yen (91%); Asia, 11,397 million yen (9%); and others, 658 million yen, with domestic sales accounting for over 90%.

Sales by Segment

Source: Omega Investment from company materials

History (See the history table on the following page)

1890-1949: from popularising inventions and patents to selling and manufacturing office equipment.

The company’s origins date back to December 1890, when founder Kiichiro Itoh founded Itoh Ki Shoten in Osaka’s Koraibashi district to promote his inventions and patents and to handle imports. In 1903, the company began importing and selling paper clips and staples. Both are commonly used in offices today but trace their origins back more than 100 years when the company started to sell them. Later, in 1908, the Itoki Shoten Engineering Department was established. It started producing office equipment such as hand-carry safes and simple stationery. In the sense that the company began its business by importing, selling and repairing foreign products after the opening of Japan to the outside world in the Meiji era, and later took on the challenge of domestic production and expanded its business, it has something in common with other Japanese manufacturing companies that are now world leaders, such as Seiko Group Corporation (Hattori Watch Shop) and Brother Industries (Yasui Sewing Machine Shop).

In 1910, the company began importing and selling English typewriters, thermal bottles, etc. In 1913, it launched the independently developed ‘Zeni-ai-ki’ (money recording and disbursing machine). In 1925, it began manufacturing its steel-made furniture, including lockers. In 1937, it expanded into Tokyo, opening a Tokyo branch in Gofukubashi, Chuo-ku.

1950-1969: Steel furniture creates modern offices. Highly regarded in terms of design.

After the war, demand for office furniture surged as Japan’s economy grew rapidly; in 1955, the company began manufacturing and selling steel desks. The company’s steel furniture subsequently paved the way for various types of desks. In 1960 it established three major systems for filing, slip accounting and office layout. In response to the demand for office rationalisation during the period of high economic growth, the company offered filing and slip accounting systems, as well as ‘office layout’, a functional arrangement of furniture, office equipment and supplies centred on desks, thereby establishing the Itoki brand in office systematisation.

Furthermore, in 1962, the company expanded into the field of home and student desks. In 1967, the company adopted the catchphrase ‘Good Design, Good System’, establishing its image as a design company.

Meanwhile, as its business expanded, the company listed its shares on the Second Section of the Osaka Securities Exchange in October 1961 and on the Second Section of the Tokyo Stock Exchange in September 1962.

1970-1989: office planning, promoting the New Office.

In the 1970s, the company began technical cooperation with overseas companies and introduced state-of-the-art office systems to Japan. Beyond the mere supply of office furniture, the company had come to offer ‘office planning’. In 1976, 14 of its products were selected for the G-Mark, and the company’s reputation for design continued to grow. Since then, many products have been awarded the G Mark every year. In 1977, the company launched a research equipment and furniture system in cooperation with the Swiss company Vivo. With this, the company entered the current Equipment / Public business field.

In 1984, local subsidiaries were established in Singapore and the USA. The company also developed its business with an eye on overseas markets. In 1985, the company adopted its CI, which is still used today. In 1987, the company was listed on the First Section of the Tokyo Stock Exchange and the Osaka Securities Exchange.

1990 to present: over 100 years in business and creating offices for the 21st century.

Even after 100 years in business, the company continues to provide products and services that meet the demands of the times. In 1994, the company began selling free-access floors to meet the needs of the times. It also focuses on quality control, and in 1998 it was registered for ISO 9001 certification. In 2001, the company completed the accreditation of all its offices.

In 2005, the manufacturing division Itoki Crebio and the sales division Itoki merged and changed the company name to Itoki Corporation. The integration of manufacturing and sales enabled quicker management decisions and rationalisation of the group in the face of accelerating global trends.

Since then, the company has developed and marketed various new products in response to the demands of the times. The company offers ergonomically designed office chairs and office furniture; in 2017, the FLIP FLAP (chair) won the international design award Red Dot Design Award.

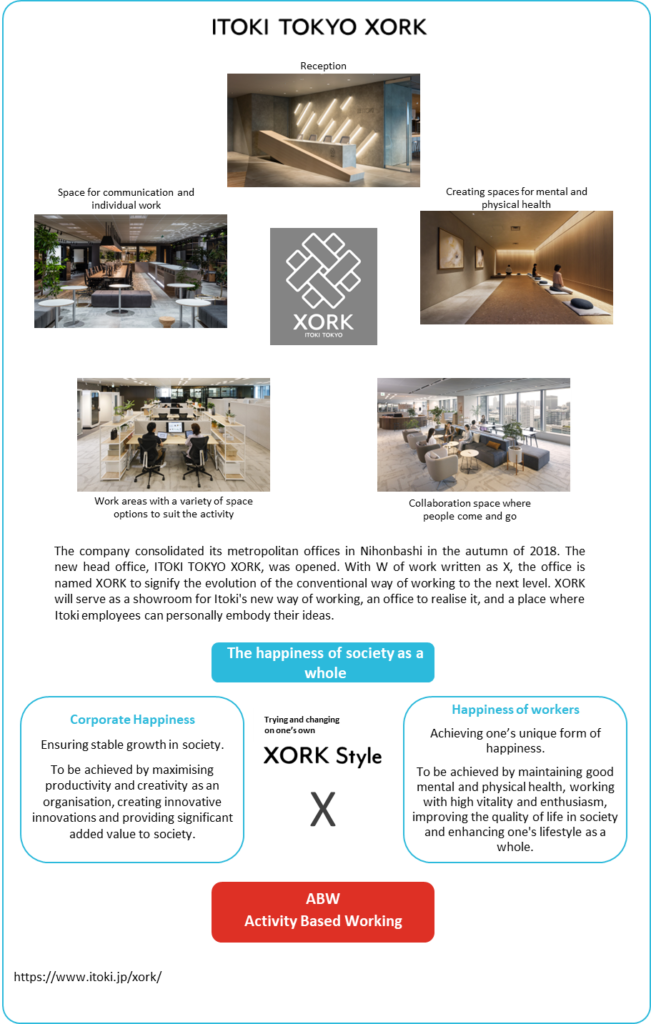

In 2018, offices in the metropolitan area were consolidated in Nihonbashi, and ITOKI TOKYO XORK was established. It advocates a comprehensive work style strategy that maximises workers’ abilities and intends to conduct various demonstrations as a place to practise the next generation of work styles, and to disseminate the various knowledge and know-how generated from these experiments to society.

Itoki Shoten was founded in December 1890 in Higashi-ku, Osaka.

In 1908 the Itoki Shoten Craft Department was established, and office equipment production began.

In April 1950, the company was spun off from Itoki Shoten and established Itoki Kosakusho Co. in Izumio, Taisho-ku, Osaka.

The main changes since then have been as follows.

| 1952 | Jul. | A new Imafuku plant was built in Joto-ku, Osaka. |

| 1954 | Dec. | Head office moved to Joto-ku, Osaka. |

| 1961 | Jan. | Itoki All Steel Co., Ltd. was established (now a consolidated subsidiary). |

| Oct. | Shares listed on the Second Section of the Osaka Securities Exchange. | |

| 1962 | Sep. | Shares listed on the Second Section of the Tokyo Stock Exchange. |

| Dec. | Home Furniture Sales Divisions opened in Tokyo and Osaka. | |

| 1963 | May | New Neyagawa plant established in Neyagawa-ku, Osaka. |

| 1968 | Nov. | Kyoto Plant established in Yawata City, Kyoto. |

| 1972 | Sep. | Shiga Plant was established in Omihachiman City, Shiga Prefecture. |

| 1974 | Jun. | Fuji Living Industry Co., Ltd. in Hakusan City, Ishikawa Prefecture became a subsidiary and produced pipe chairs (currently a consolidated subsidiary). |

| 1984 | Aug. | Kyoto Plant No. 2 was established in Yawata City, Kyoto, relocating the Imafuku Plant. |

| 1986 | Nov. | An electronic device manufacturing plant was established in Omihachiman City, Shiga. |

| 1987 | Jun. | Listed on the First Section of the Tokyo Stock Exchange and Osaka Securities Exchange. |

| 1991 | Oct. | A chair manufacturing plant was established in Shiga Omihachiman City, Shiga. |

| 1992 | Aug. | Kyoto Plant No. 2 is relocated to Omihachiman City, Shiga. |

| 1999 | Aug. | Expansion of the Neyagawa plant in Neyagawa-ku, Osaka. |

| 2000 | Oct. | Itoki Technical Service Corporation was established. |

| 2002 | Nov. | Established Itoki (Suzhou) Furniture Co., Ltd. in China (now a consolidated subsidiary Novo Workstyle (China) Limited). |

| 2003 | Mar. | Itoki Market Space Inc., was established (now a consolidated subsidiary). |

| 2005 | Jun. | Merged with the former Itoki Co., Ltd. and changed its name from Itoki Crebio to Itoki Corporation. |

| Nov. | The Shiga Logistics Centre was established in Omihachiman City, Shiga. | |

| 2007 | Dec. | Acquired shares of Business Jimki Corporation and changed the company name to Itoki-Hokkaido Co., Ltd. |

| 2008 | Dec. | Kanto Plant is established in Midori-ku, Chiba City, and partially relocating the Kyoto Plant. |

| 2011 | Apr. | Included Dalton Corporation and its five subsidiaries under the umbrella as subsidiaries, producing and selling research equipment and powder machinery (now a consolidated subsidiary). |

| 2015 | Mar. | Included Shin Nihon System Technology Corporation into the group as a subsidiary to develop various systems (now a consolidated subsidiary). |

| Jul. | Itoki Engineering Centre Co., Ltd., Itoki Osaka Engineering Centre Co., Ltd. and Itoki Technical Service Co., Ltd. merged and changed their name to Itoki Engineering Service Corporation (now a consolidated subsidiary). | |

| 2016 | Dec. | Tarkus Interiors Pte Ltd., an interior decoration company based in Singapore, became a subsidiary (now a consolidated subsidiary). |

| 2017 | Jul. | Novo Workstyle Asia Limited was established in Hong Kong (now a consolidated subsidiary). |

| 2018 | Nov. | The new Tokyo head office “ITOKI TOKYO XORK” (XORK) opened in Chuo-ku, Tokyo. |

| 2020 | Jun. | ITOKI CHINA HOLDING Co., Ltd. was established in China (now a consolidated subsidiary). |

| 2022 | Apr. | Moved from the First Section of the Tokyo Stock Exchange to the TSE Prime market following a review of the TSE’s market classification. |

| 2022 | Nov. | The AP Centre (Ampoule Process Centre) was established in Omihachiman, Shiga Prefecture. |

| 2023 | Apr. | Itoki Hokkaido Co., Ltd, a consolidated subsidiary of the company, is merged into the Company. |

Source: company’s annual securities report

Source: company materials

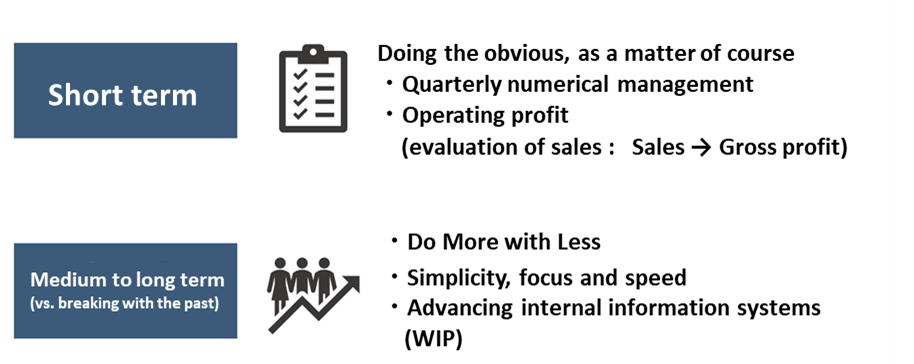

Management leadership in the spotlight

One recent development of note is the current management team.

The current President and CEO, Koji Minato, joined the company in September 2021 and assumed his current position in March 2022. He joined NTT in 1994 and holds an MBA from USC. He has since served as general manager of Sun Microsystems and (after Oracle acquired Sun Microsystems) vice-president of Oracle Japan, an unusual background for a top corporate executive.

He is expected to appropriately guide the company in light of technological trends, such as the shift to IoT in the office, and to utilise his management experience in foreign-owned companies to activate internal human resources and improve financial performance.

Since taking over as president, his performance has fully met these financial, qualitative and share price expectations. The existing medium-term management plan, RISE ITOKI 2023, has largely achieved its targets, with sales and operating profit reaching new highs, employee engagement improving, and the share price rising from 347 yen to 1,782 yen between end-March 2022 and end-March 2024, as evidence of this.

His skills will be further demonstrated in the new medium-term management plan starting in FY2024.

President Minato’s approach

Source: Omega Investment from company materials

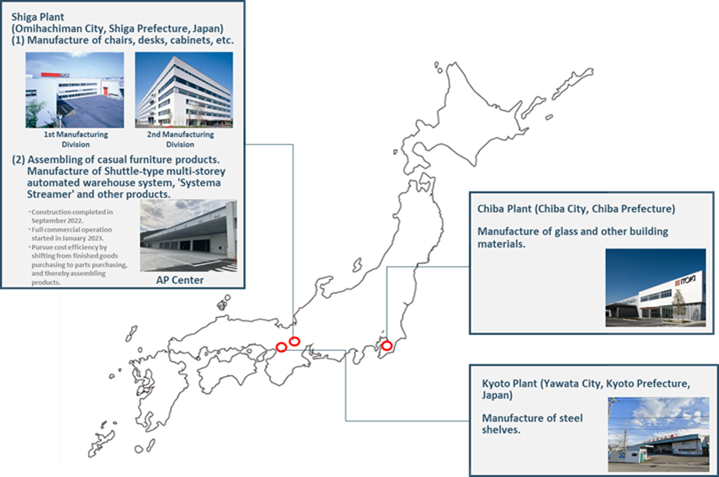

Production structure

Source: Company materials

Group overview

As seen in the history, the company was founded in Osaka, but its current head office is in Chuo-ku, Tokyo (relocated in 2018). The company group comprises 32 consolidated subsidiaries, seven non-consolidated subsidiaries, and two companies (see next section). Since the 2000s, the company has been actively expanding overseas, particularly in ASEAN and China, acquiring local companies and establishing subsidiaries and affiliates in each region.

Production structure

The company’s production system is based at its domestic plants. This is because the company’s primary market is the domestic market, and office furniture is bulky in volume due to its storage characteristics, so it is not cost-effective to produce it overseas and import it at high transport costs.

The current main plant is the Shiga Plant, which manufactures chairs, desks, cabinets, and other products for the Workplace business. It employs about 300 people. In September 2022, the Assembling Process Centre (AP Centre) was opened at the same site, which started full operation in January 2023. The AP Centre is working to reduce the cost ratios by centrally managing the company’s products’ storage, assembly, and shipping. The centre will also relocate the production line for the system streamer SAR-R, whose demand is increasing rapidly in the logistics market, to meet growing demand. The Neyagawa plant, one of the company’s main plants for many years, was closed in 2022, with its production consolidated at the Shiga plant. The company sold the idle land of the plant for 6.5 billion yen and is working on improving asset efficiency.

Business diagram

See the next page for a diagram of the business structure. The company and its group companies are involved in manufacturing, sales, construction, interior decoration, installation, and maintenance services.

Overseas office furniture manufacturers often specialise only in manufacturing and sales and rarely provide interior design, construction, or workplace design. In Japan, consulting companies and office design firms are generally engaged between the office furniture provider and the client for large-scale projects to provide work style design and workplace design. However, in recent years, office furniture manufacturers have also started to offer a comprehensive service from upstream to construction and delivery of office furniture, starting with small and medium-sized projects, to obtain fees commensurate with the proposal’s value.

Major consolidated subsidiaries

Company name |

Business activities |

Itoki All Steel Co., Ltd. |

Manufacture of counters, large top desks, wall storage furniture, desk panels, etc. |

Fuji Living Industry Co., Ltd. |

Manufacture of meeting and amenity chairs. |

Itoki Market Space Inc. |

Sales of shop fixtures/store planning |

Itoki Engineering Service Corporation |

Project management of office renewal and relocation, management of office furniture layout delivery, and maintenance and inspection services for various other equipment. |

Simasobi Corporation |

Processing and sale of office furniture, office supplies and interior decorations, and contracting of electrical work |

Itoki Toko Manufacturing Co., Ltd. |

Manufacture of steel doors, safety deposit boxes, various types of shielding doors, fire-resistant walls, nuclear radiation shielding doors, etc. |

Itoki Marui Industry Co., Ltd. |

Manufacture of steel office machinery and equipment |

Sanko Facilities Inc. |

Sales of office equipment, furniture, fixtures and incidental goods, construction work, design management |

FMSTAFF Ltd. |

Consulting services related to facility management, etc. |

Itoki Shared Value Co., Ltd. |

Office space sharing business, office furniture rental and reuse business, etc. |

Shin Nihon System Technology Corporation |

Provision of IT solution services |

Dalton Corporation |

Design, manufacture and sale of research and education equipment; design and sale of powder processing machinery; design and sale of high-tech plant systems. |

MUTO-SAFE Co., Ltd. |

Agency |

Tarkus Interiors Pte Ltd |

Singaporean interior decoration company, made a subsidiary in 2016. |

Novo Workstyle Asia Limited |

Regional business headquarters for Asia, in Hong Kong, established 2017. |

Novo Workstyle CO., Limited |

Established in Jiangsu Province, China, to supply manufacturing components. |

ITOKI SYSTEMS (SINGAPORE) PTE., LTD |

Singapore subsidiary, sales of office furniture, proposals and logistics systems |

ITOKI CHINA HOLDINGS Co., Ltd. |

Holding company for Chinese operations. Under the umbrella of Novo Workstyle Co. Offices in Beijing, Shanghai, Suzhou, Shenzhen, etc. |

15 other companies |

Business diagram

Source: Omega Investment from company materials

Business overview

Workplace business

A core business accounting for 71% of the consolidated sales: focus on proposal-based marketing to improve profitability.

The company’s Workplace business recorded FY12/2023 sales of 94.2 billion yen, an operating profit of 6.1 billion yen and an operating profit margin of 6.5%. Sales grew by +9.7% YoY, operating profit by +137.6% YoY and operating profit margin by +3.5 percentage points YoY, achieving both sales growth and improved profitability. The operating profit margin has steadily improved over the past three years, indicating that the management policy of emphasising added value and profitability is gaining ground.

Sales by region were 82,573 million yen (88.0% of the total) in Japan, 11,220 million yen (11.7%) in Asia and 462 million yen (0.3%) in others, indicating that the domestic business is currently the main focus. However, the company is also looking to expand overseas markets.

Since the launch of steel desks in 1955, the company’s office furniture business has successively developed and provided products to meet office needs in line with Japan’s economic growth and corporate business expansion. The company has made a significant contribution to developing the Japanese economy.

In the Workplace business, the aim is not just to sell office furniture but to provide higher added value by proposing workplace design and obtaining commensurate value. In the past, it was challenging to differentiate office furniture on a stand-alone basis, leading to price competition, which in turn led to significant discounts together with non-office fixtures and fittings, which sometimes resulted in a decline in profitability. Although the company’s office furniture was originally well-designed and had won many G Marks (see figure above, next page), it could be said that the company needed to receive more compensation commensurate with the value it provided. As mentioned above, recent efforts to review the operating structure and culture (from a focus on sales to a focus on profit), generate revenue commensurate with enhanced customer value, and sell higher-value-added products and services are bearing fruit.

Workplace business revenue and profit trends

| Workplace business /Financial year | 2020/12 | 2021/12 | 2022/12 | 2023/12 |

| Net sales | 83,032 | 80,561 | 85,945 | 94,257 |

| YoY | -3.0% | 6.7% | 9.7% | |

| Segment profit | 1,273 | 1,914 | 2,579 | 6,128 |

| YoY | 50.4% | 34.7% | 137.6% | |

| profit margin | 1.5% | 2.4% | 3.0% | 6.5% |

Source: Omega Investment from company materials

History of Good Design Awards won by the company

Note: Examples are mainly Good Design Best 100 award-winning products. The company has received a total of 86 Good Design Awards since 2005

Source: Omega Investment from company materials

The office furniture market could add value as new ways of working evolve.

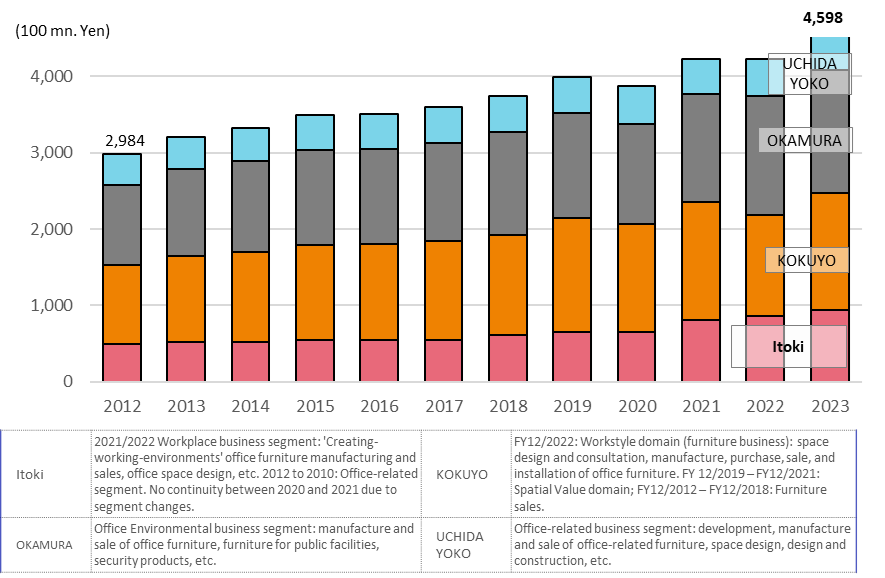

Japan’s office furniture market: market size of 800 billion yen, with stable growth.

The Japan Office and Institutional Furniture Association (JOIFA), of which 109 office furniture-related companies are members, carries out various activities as an industry association and publishes statistics and surveys as appropriate. JOIFA is presumed to have a grasp of the size of the office market in Japan but currently does not reveal the data. Therefore, as a rough idea of the market size, reference values extracted from the segment information of the four major office furniture companies, including the company, for the total of the four companies have been graphed (however, differences in the segment definitions of the companies and differences in the accounting periods have been ignored; Itoki and Kokuyo’s figures for the December period and Okamura’s figures used the FY2024 company forecast for FY2023 are shown in the graph. For Uchida Yoko, the figures up to FY07/2023 are used.). Looking at each company’s share within these four companies, in 2023 the company has 20%, Kokuyo 33%, Okamura 35% and Uchida Yoko 11%. Kokuyo and Okamura each hold almost 1/3 of the market share, with the company in third place and Uchida Yoko in fourth place, a positioning that has long been established. In addition, the market appears to be growing almost steadily (3-4%). When the sales of companies other than the four are included, the market is estimated to be worth around 800 billion yen per year (of which around 400 billion yen is office furniture alone, the rest consists of consulting and installation) (Omega Investment estimate based on the sales size of JOIFA member companies, etc.).

Office furniture business sales of the four major office furniture companies

Source: Prepared by Omega Investment from the annual reports of the companies.

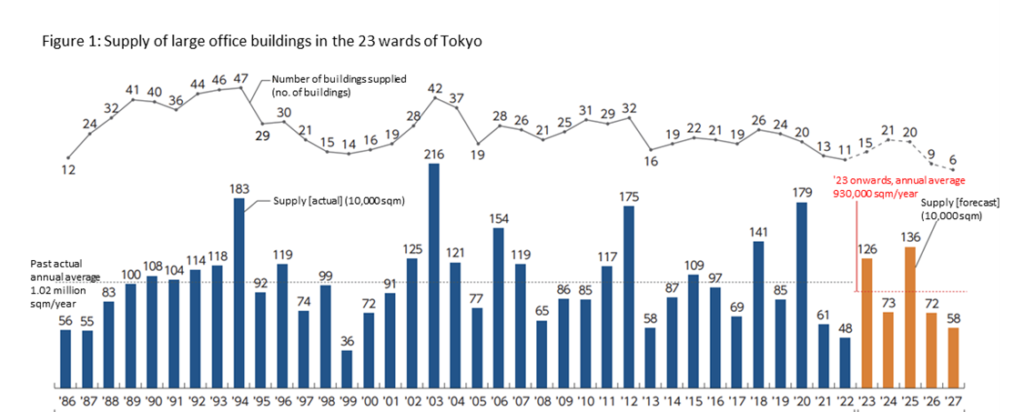

Supply of large office buildings in the 23 wards of Tokyo (Mori Building survey)

Source: Omega Investment, based on Mori Building’s ‘Tokyo 23 Wards Large Office Building Market Trend Study 2023’.

Office building market outlook: The new supply of gross floor space will decrease in 2024, but supply will increase

Demand for office furniture tends to be influenced by the supply of new office buildings, economic trends and corporate performance. According to Mori Building’s ‘Tokyo 23 Wards Large Office Building Market Trend Survey 2023’, the supply of large office buildings is expected to decline in gross floor area in FY2024 and then move back and forth. However, the number of units is expected to remain firm until FY2025. Note that this document is updated once a year with the latest values.

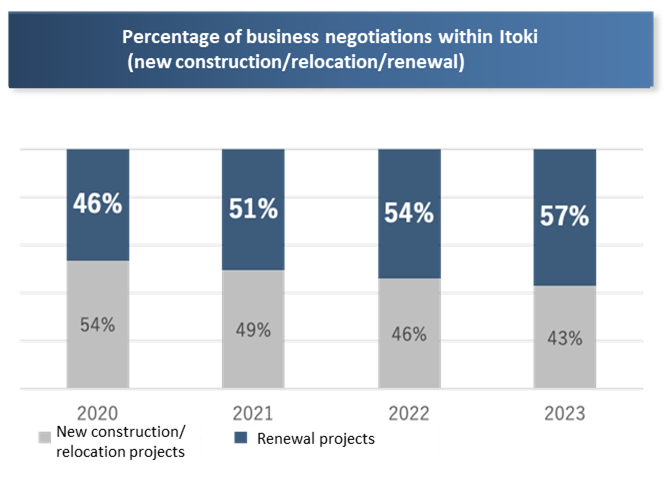

In addition, it is not only new office construction and relocations that affect the performance of the business but also the demand for renewals. As shown below, most business negotiations are for renewal projects, and the proportion is increasing yearly. This can be attributed to the fact that customers are increasingly interested in office productivity and that the company is becoming increasingly recognised as a provider of solutions to this need. In light of the above, the business can be expected to grow without being restricted to new supply.

Percentage of business negotiations within Itoki (new construction/relocation/renewal)

Source: Company materials

Recent developments in the office furniture market: new business opportunities due to the increasing sophistication of office needs.

In recent years, office needs have undergone a significant transformation. The office’s role has changed from the past, partly due to the introduction of remote working due to COVID-19, and this could mean new business opportunities for office furniture companies. Background includes.

a)Reform of work style: the Japanese economy has been stagnant for a long time. As the era of high growth, when productivity could be increased mainly in the manufacturing sector, ended and the proportion of tertiary industry increased, it became difficult to increase productivity, particularly among white-collar workers. Against this backdrop, there are indications that productivity should be improved through reforms in how people work. To achieve this, the internal organisation of Japanese companies needs to change, and the composition of corporate offices is undergoing a significant transformation from the old fixed-seat-based office environment (see figure, next page).

b)Advances in IT and networking: the way work is carried out in a company has changed significantly over the last 10-20 years due to IT development. The office must respond to the evolution of hardware, software, networks, etc. The change has been within the scope of Itoki’s Office 2.0, which the company has advocated. In the future, Office 3.0, or the DX orientation of the office, will determine competition for superiority between companies.

c)The office as a place for new value creation: as indicated in a), how people work will change significantly. The pandemic disease has triggered the introduction of remote work, but at the same time, it is still essential to have places where people meet face-to-face and communicate with each other. In the future, it will be crucial to maximise workers’ abilities by combining the central office as a place to share experiences with remote work, which is a flexible way of working at a high level.

The changing role required of offices

Source: Omega Investment from company materials

d)Attracting high value-added human resources: human resources are the biggest asset for future growth in all companies, but IT and other creative personnel need more supply. To retain such talented people, it is essential to have a great office environment and space.

The company’s approach: multiplying Office 1.0, 2.0 and 3.0 to increase corporate value.

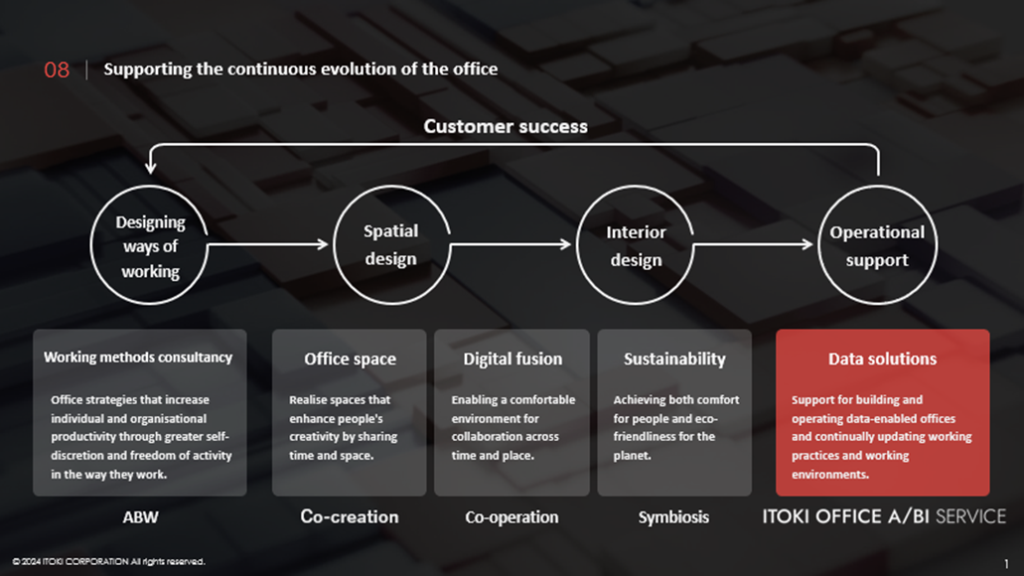

The company’s answer to the changes in the office furniture and office space market described above is shown in the diagram below: in Office 2.0, the company has added value through office design and construction in addition to manufacturing and selling office furniture. Office 3.0 will further promote office DX. Data is collected by attaching sensors to office furniture and various parts of the office. By analysing this big data, it will be possible to provide customers with higher value-added services.

The company’s proposed Office 3.0 concept

Source: Company materials

As a place to put Office 3.0 into practice, the company consolidated its Tokyo headquarters in Nihonbashi in 2018 and opened ITOKI TOKYO XORK, which also serves as a showroom. For more information, see the next page.

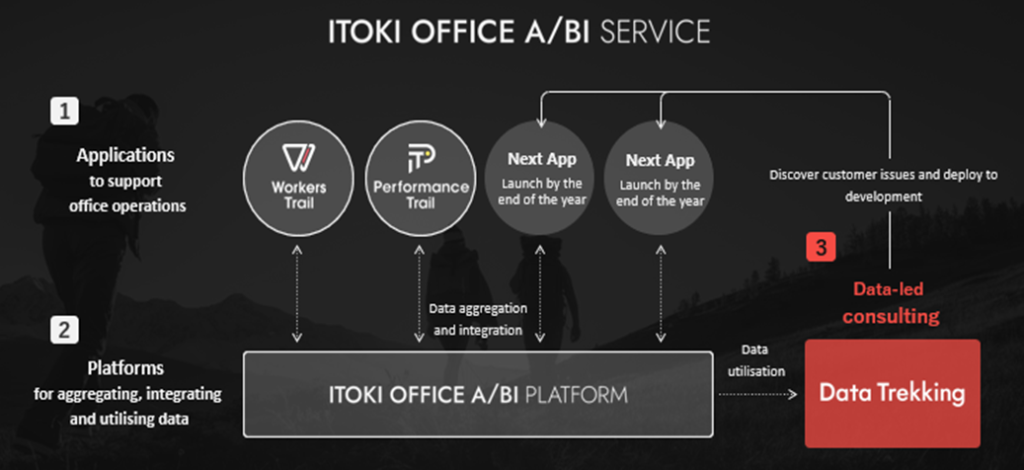

This concept will materialise in 2024 as a ‘Data Trekking’ service based on the ITOKI OFFICE A/BI PLATFORM.

The service was launched on 14 February. It is a consulting service for customers planning to relocate or renew their offices, using sensing data in the office as a guidepost to support agile office construction and operation in a companionable manner.

This system is for accumulating and analysing space operation data, organisational survey data, layout data and customer-specific index data based on a unique platform, the ITOKI OFFICE A/BI PLATFORM. Data is acquired using Workers Trail, an application that enables visualisation of “work” using beacon-based location information. Itoki’s proprietary cloud-based organisational survey allows for visualising individual and organisational performance and conditions. Itoki’s proprietary Performance Trail is a cloud-based organisational survey that visualises individual and organisational performance and conditions. The company’s consulting team will analyse the data using the Office Data Map, a dashboard-type system developed independently by the company, which will be linked to the office designers.

Furthermore, on 13 March, the company signed a joint development agreement for generated AI with AI start-up AKARI Inc. and has started developing applications related to automatic office design generation AI as part of the ‘ITOKI OFFICE A/BI SERVICE’ initiative.

Such a development will capture customers’ individual needs and specifically help them reform their office productivity. It has the potential to improve customer satisfaction, retain customers, and generate recurring revenues. The future development of this system will be the focus of much attention.

Source: Company materials

Data Trekking service based on ITOKI OFFICE A/BI PLATFORM.

Source: Company materials

Peer competition:

As seen in the office furniture market, the four major players in this market – the company, Kokuyo (TSEP: 7984), Okamura (TSEP: 7994) and Uchida Yoko (TSEP: 8057) – hold about 50% of the market. The table below compares each company’s most recent figures and other data. All but Okamura have a history of more than 100 years, while Okamura also has a long track record of more than 70 years. Regarding the companies’ businesses, most sales for Itoki Corporation and Okamura come from office furniture, fixtures, and fittings for commercial facilities. Kokuyo, on the other hand, as is well known, also generates a large proportion of its sales from stationery-related products. For Uchida Yoko, public-related (e.g., education-related ICT) and information-related (e.g., software licensing) sales account for 80% of its sales.

The graph on the next page compares the profitability of each company’s office furniture business; as noted on page 11, the definition of each company’s segment is not necessarily the same, but it should give a rough indication. Kokuyo and Okamura, which have high market shares, deliver high profit margins. Kokuyo has been increasing its profit margin by more than 10% in recent years by focusing on proposal-based marketing and projects for which it can charge a design fee. While Uchida Yoko has achieved high profit margins in its non-office-related businesses, it has been spoilt by low profit margins in its office-related businesses.

Four office furniture companies, operating profit margin trends in office furniture-related businesses

Source: Prepared by Omega Investment from the annual reports of the companies.

On the other hand, Itoki Corporation earned a profit margin of nearly 5% in 2012, but its profit margin has since declined. When competing with the top two companies, the profit margin appears to have lowered due to price discounts and other measures to secure sales rather than profit margins. The company has recognised the problem and is working to improve profit margins by optimising sales prices in line with its value, strengthening and expanding its consulting services, and monetising services such as delivery and design fees. These have started to show results in recent years.

Equipment / Public business

Logistics-related facilities, research facility equipment and other unique products.

FY12/2023 sales in the company’s Equipment / Public business were 36,466 million yen (+3% YoY), operating profit was 1,906 million yen (+28% YoY), and operating profit margin was 5.2%.

Sales by region were 36,466 million yen in Japan, 177 million yen in Asia, and 195 million yen in other areas. Again, the domestic market is the main market.

The profit margin in this business also continues to improve steadily year on year.

Equipment product range

Source: Company materials

Equipment / Public business revenue and profit trends

| Equipment / Public business /Financial year | 2020/12 | 2021/12 | 2022/12 | 2023/12 |

| Net sales | 31,602 | 33,488 | 35,667 | 36,839 |

| YoY | 6.0% | 6.5% | 3.3% | |

| Segment profit | 1,225 | 974 | 1,482 | 1,906 |

| YoY | -20.5% | 52.2% | 28.6% | |

| profit margin | 3.9% | 2.9% | 4.2% | 5.2% |

Source: Omega Investment from company materials

The Equipment / Public business dates to 1914, when the company began selling vent-type safes. Since then, the company has manufactured and sold a variety of warehouse-related fixtures and fittings and, since the 1980s, has been an industry pioneer in developing and supplying a range of automated warehouse equipment. Based on its experience producing safe doors, the company also produced and launched special large doors for nuclear power facilities. The company has continued developing numerous industry firsts, including developing secure locking systems. In recent years, there has been an extreme need for automation equipment for warehouse and distribution systems.

The main customers for logistics equipment are the automotive industry and equipment manufacturers. The main customers for public facilities products are museums, art galleries and libraries. Sales of logistics equipment depend on economic trends and corporate earnings. Still, they are expected to grow, as reducing logistics costs is an ongoing and vital management issue in the manufacturing industry. On the other hand, sales of public facilities are affected by budget execution by public offices and local authorities.

In the same segment, research equipment is another product to note. Dalton Corporation, which the company invested in in 2011 and became a wholly owned subsidiary in 2016, manufactures and sells these products. Dalton Corporation was founded in 1939 as a manufacturer and distributor of scientific instruments and glassware for analysis (the company was called San-Ei Seisakusho when it was founded). It established a scientific research facilities division, which developed and sold products used in various research facilities; in 1996, it acquired a powder and granular equipment manufacturer and expanded into powder machinery; in 2014, it introduced the Uni-X Lab Series of draft chambers and laboratory tables.

Dalton Corporation research facility equipment

Source: Omega Investment from company materials

Customers of laboratory equipment include pharmaceutical companies, universities and research institutions, and the sales are affected by trends in R&D expenditure/capital investment by pharmaceutical companies and scientific research funding by universities. Pharmaceutical companies, the largest customers, actively invest in R&D expenditure to develop new drugs. On the other hand, while there are concerns that research budgets at Japanese universities continue to be cut, major pharmaceutical customers’ robust research investment budgets are expected to continue. Hence, the sales of the company’s research facility equipment should grow.

Financial results

FY12/2023 financial results

◇ Establishment of a profitable structure. Highest profit and dividend increase.

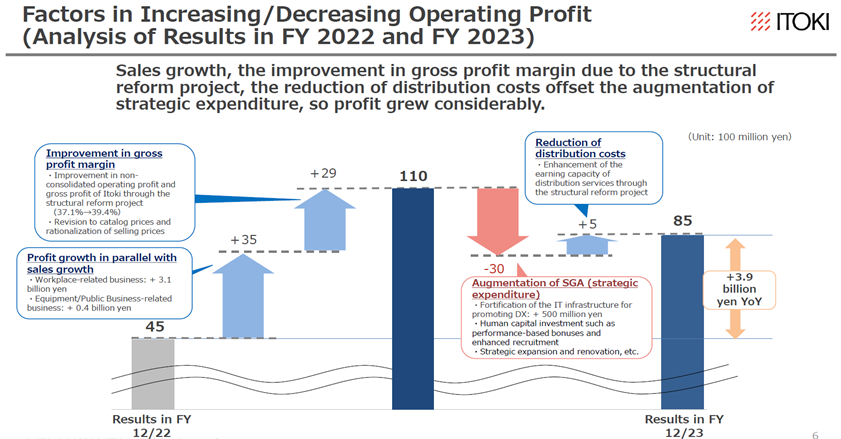

The company’s FY12/2023 results showed sales of 132.9 billion yen (+8% YoY) and operating profit of 8.5 billion yen (+86% YoY), with sales, operating profit, recurring profit and net profit all reaching record highs.

While steadily building up sales from renewal projects and office relocations, the company significantly improved its profit margin through enhanced customer value. As a result, profits exceeded the company’s forecasts despite increased SG&A expenses due to strategic spending.

By segment, the Workplace-related business and the Equipment / Public business-related business each posted increased revenue and operating profit, and operating profit margins improved. The results were flawless.

In addition, the company increased its year-end dividend by 5 yen YoY to 42 yen for FY12/2023, reflecting its strong earnings.

As indicated by the strong performance of the peers in the industry, the industry environment is favorable, benefiting from the tailwind. In particular, the company’s operating profit margin has quickly risen to the 6% range, a level not seen in the past ten years. The company should be commended for its progress in strengthening its structure under President Minato’s leadership. It can be said that the company has completed the “To develop an earning structure” in the final year of its mid-term plan.

Source: Company materials

◇ The previous medium-term management plan was achieved:

In FY12/2023, the company delivered results on target vis-a-vis the previous medium-term plan, with sales largely in line with expectations and operating profit, operating profit margin, and ROE exceeding targets (see graphs below). The company’s internal factors, mainly at the parent company, such as a shift from equality to fairness in personnel evaluations to empower employees, a thorough focus on profitability, and enhanced proposal capabilities for office design, etc., are thought to have had a multilayered effect.

Two points are particularly noteworthy in these results. The first is that employees are more proud of the company than before, which is a positive result of employee engagement, and the second is that ROE has improved to 11.3%, which has led to an increase in the share price and a PBR over 1x.

The company’s “To develop an earning structure” has not only improved financial figures but has also been positively received by employees, and this overall strengthening of the company’s structure is likely to have improved investors’ evaluation of the company.

Source: Company materials

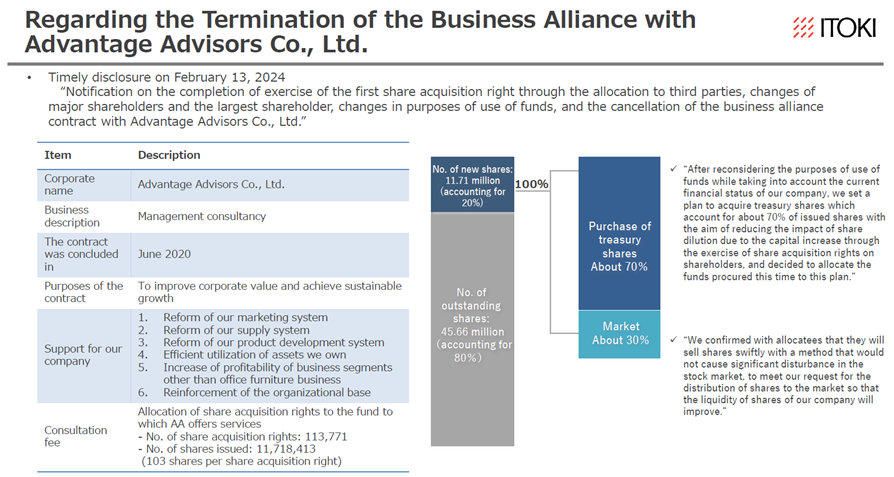

◇ End of business alliance with Advantage Advisors Co.,Ltd.:

According to the company’s timely disclosure on February 13, 20, and 21, 2024, the stock acquisition rights issued to Advantage Advisors (AA, after this) were exercised in full on these dates, resulting in the issuance of 11.7 million shares of common stock, and 4.07 billion yen was paid to the company as compensation for this issuance. On February 21, the company repurchased 7.965 million shares for 15.9 billion yen. According to the February 28 large volume shareholding report, AA completed the sale of all of the company’s shares acquired in the transaction.

The key points are as follows. This is a minor concern from a medium- to long-term perspective.

– Increase in the number of shares outstanding: The number of shares outstanding at the end of December 2023 was 45.3 million after deducting treasury stock, and after this series of transactions, the number of shares outstanding after deducting treasury stock will be 49.1 million. This represents an increase of approximately 8% in the number of shares, which is a reasonable level of dilution. Considering future earnings growth and an increase in the dividend payout ratio, this increase should be acceptable to many shareholders.

– Financial burden: Although the company spent approximately 12 billion yen, it has a net cash position of approximately 8 billion yen as of December 2023. Given the company’s remarkable improvement in profitability, there should be no problems in terms of debt financing, including borrowings and interest rates.

– Disposal of treasury stock: About half of the 4 million shares acquired this time were cancelled (March 8, 2024). The remainder may be used for executive compensation or M&A, but there are currently no plans to re-release the shares on the market. Therefore, there is no immediate impact on the supply-demand side of the stock.

– Impact of the termination of the business alliance: Based on the company’s financial results and the message from management, it appears that the company has implanted in itself the ability to build a profitable structure, so the direct negative impact of the termination of the business alliance is expected to be small.

Source: Company materials

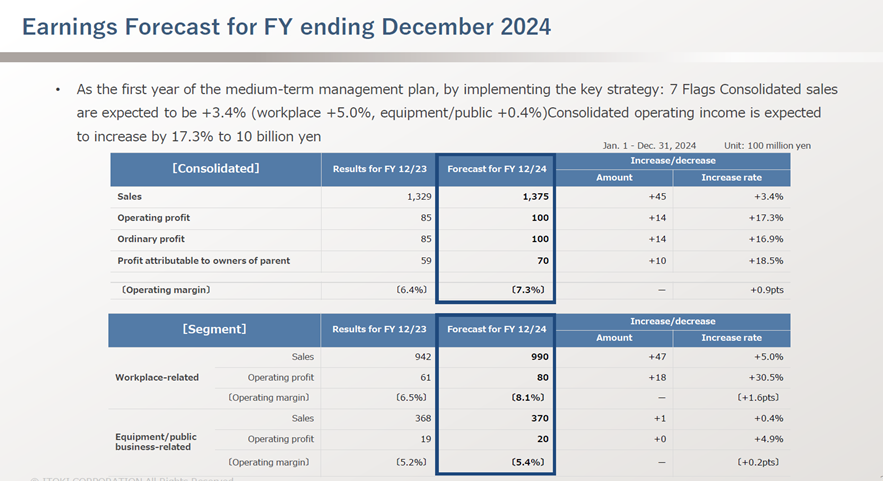

◇ FY12/2024 company forecast: Continued sales and operating profit increase, and operating profit margin to rise further.

The company projects sales of 137.5 billion yen (+3% YoY), operating profit of 10 billion yen (+17% YoY), recurring profit of 10 billion yen (+17% YoY), and net income of 7 billion yen (+19% YoY), which would be an increase in sales and a further improvement in the operating profit margin.

The sales forecast is in line with the current growth rate of business negotiations in force. Meanwhile, the company’s operating profit, excluding strategic SG&A expenses, was 11 billion yen in FY12/2023, which means it is already within range of its 10 billion yen operating profit forecast.

Source: Company materials

Growth strategy

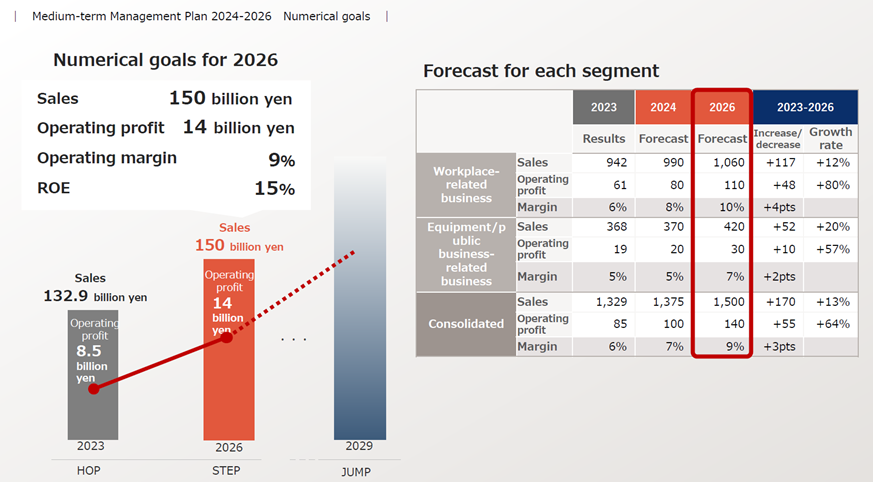

◇ New medium-term management plan RISE To GROWTH 2026: Moving into “Profitability enhancement phase”

On 13 February 2024, the company announced its new medium-term management plan, RISE TO GROWTH 2026, covering 2024-2026. It is positioned as a ‘high-profitability phase’ to enhance sustainable growth.

As mentioned earlier, the nature of the workplace, including the office, and its productivity improvements are attracting increasing attention. The thinking style of management at client companies is changing from a one-dimensional view of the office as a cost to a view of the office as an object of human capital investment that pursues investment effects. Furthermore, office DX and the IoT of office equipment are expected to advance. The company holds the mission “We Design Tomorrow. We Design WORK-Style”, hoping that this transformation in workplace needs will lead to a long-term leap forward for the company.

This medium-term management plan is based on the “Tech x Design based on PEOPLE” concept and consists of the vital strategy “7 Flags” and ESG strategies.

The company’s financial targets for FY2026 are sales of 150 billion yen (up 13% from FY12/2023), operating profit of 14 billion yen (up 64%), operating profit margin of 9% (up 3 percentage points), and ROE of 15% (up 4 percentage points). These are more focused on improving profitability than increasing revenue and show the company’s ambition to become an industry leader in terms of profitability by 2026.

Operating profit is expected to increase by a cumulative +5.5 billion yen from the current level, of which +4.8 billion yen is planned to be covered by increased earnings from the Workplace business. More specifically, the profit plan is based on the effects of improvements through enhanced customer value, cost reductions in production and logistics, improved profitability overseas, group synergies and increased revenues. It is set as a must-achieve target rather than a challenging target.

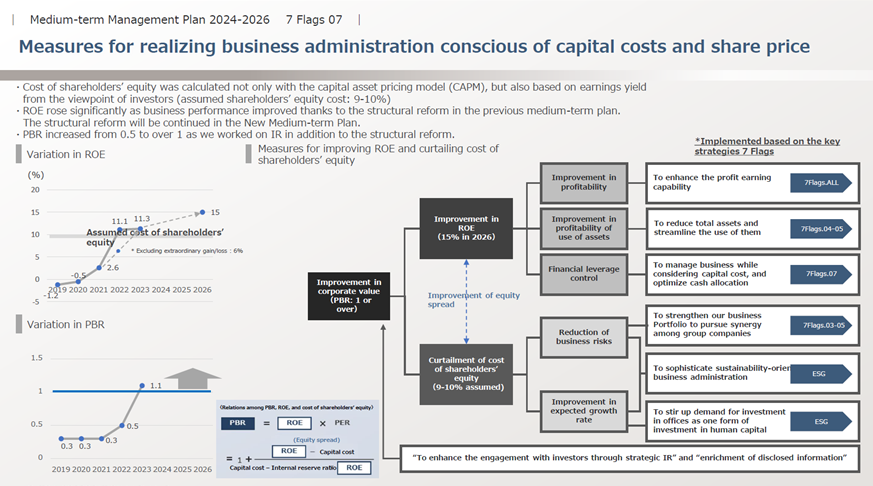

The company’s message to the stock market is to maximize shareholder value and improve PBR by reducing the cost of capital while aiming to achieve ROE in excess of the assumed 9-10% cost of equity capital. Regarding shareholder returns, the company will raise its dividend payout ratio by 10 percentage points to 40%. This is more than sufficient to meet the current expectations of the stock market.

The details of the plan will be discussed later in this report. Still, it can be said that it is a broadly well-developed plan that includes strengthening the core business base, seeding new office-related businesses, developing specialized facility areas, strengthening the earnings structure on a consolidated basis, human capital, and financial strategies.From the plan’s first year, investors are likely to pay close attention to the rate of progress toward financial targets.

Source: Company materials

The following is a summary of these seven priority measures and their KPIs.

Source: Omega Investment from company materials

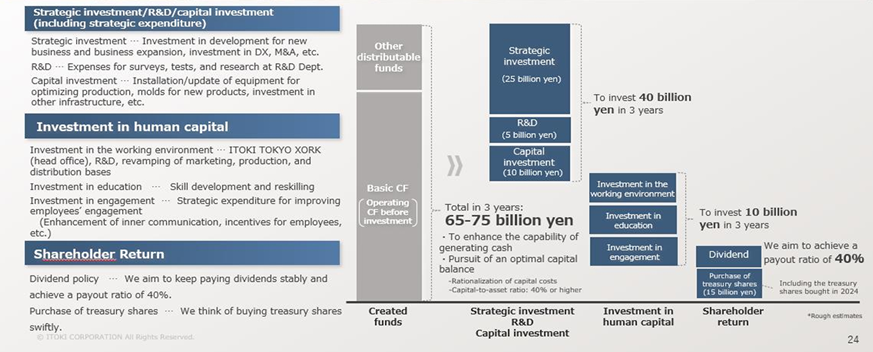

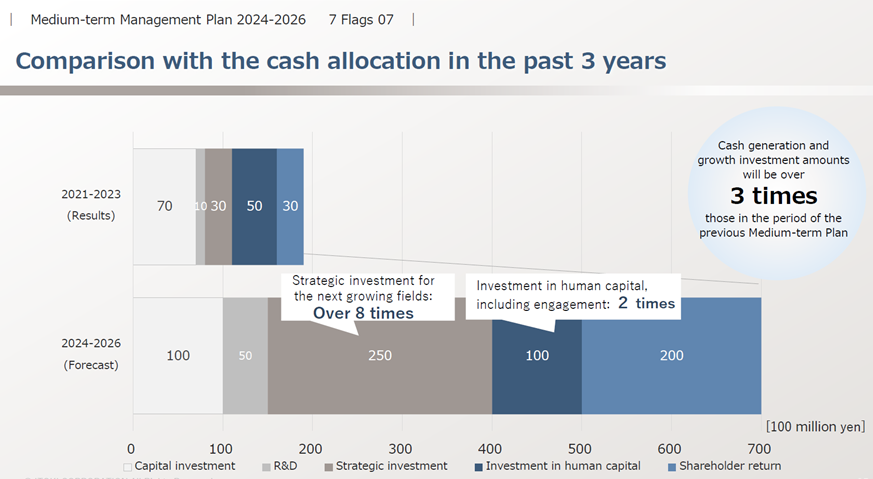

Supplementary Information: Allocate the results of improved profitability to reinvestment in line with the medium- to long-term strategy and strengthen shareholder returns.

Supplementary Information: Achieve ROE that exceeds the cost of shareholders’ equity and promote higher PBR through expansion of equity spread.

Source: Company materials

◇ Share price trends and focus: the results of reforms are reflected in share prices.

From the end of March 2022, when President Minato took office, to the end of March 2024, the company’s share price rose from 347 yen to 1,782 yen, and PBR went from below 1x to about 1.5x. It is believed that the management policy and performance under President Minato’s regime have significantly turned around investment sentiment, which was concerned about the receding office needs that emerged with the COVID-19 disaster and the company’s past low profitability.

Secondly, there is a danger that when investors consider the company’s prospects, they are too caught up in the view that it sells goods to domestic offices, which narrows their view of the company’s future potential. This view should be swept away, and the company’s future should be assessed flatly.

In other words, progress on qualitative milestones should be considered in addition to the financial KPIs outlined in the medium-term management plan.

The company’s 2027-2029 business profile is likely to become more apparent as the following factors come into play: a strong need to improve office productivity, a greater focus on profits on a consolidated basis, greater employee motivation for creativity and ingenuity, an increase in the proportion of selling functions revenue, and new revenue opportunities outside the domestic office sector such as logistics and laboratories, as well as expansion into the Asian market. As a result, the share price could move to the next stage.

Long-term trends in Itoki’s share price and relative to TOPIX

Source: Omega Investment

Source: Company materials

Valuations

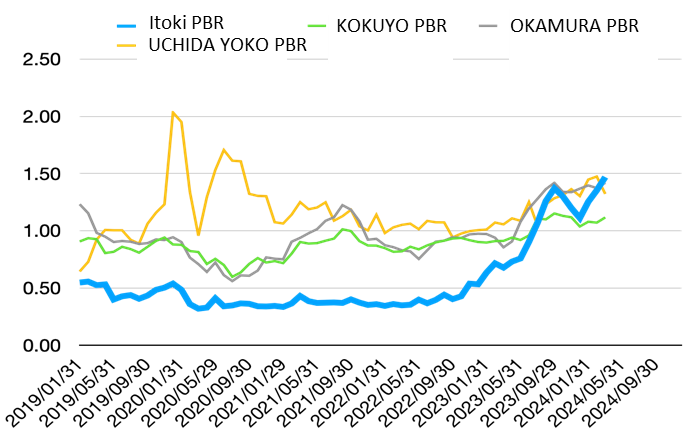

Below are the ROE trends (including projected ROE for Okamura and Uchida Yoko for the ongoing period) and PBR trends for the company and its three peers over the past five years.

Clearly, the company’s ROE has improved to a level comparable to its competitors due to its improved profitability, and PBR has risen accordingly to a level equivalent to its peers.

On the other hand, profit growth and further improvement in ROE are considered essential as future share price drivers. The ROE target in the company’s new medium-term management plan is 15%, an improvement of 4 percentage points on the latest figures. As the ROE target becomes more feasible, there will be more scope for PBR to expand.

Source: prepared by Omega Investment based on financial data from various companies.

Share price and financial data of four office furniture companies

| Code | 7972 | 7984 | 7994 | 8057 | |

| Company name | Itoki | KOKUYO | OKAMURA | UCHIDA YOKO | |

| Financial year | December, 2023 | December, 2023 | March, 2023 | July, 2023 | |

| Share price (4/19) | 1,819 | 2,517 | 2,269 | 6,730 | |

| Market cap. (milion yen) | 88,772 | 286,913 | 214,752 | 66,250 | |

| PER (x) | 11.78 | 13.41 | 10.68 | 11.04 | |

| PBR (x) | 1.50 | 1.14 | 1.34 | 1.24 | |

| Dividend yield (%) | 2.86 | 3.02 | 3.79 | 2.82 | |

| Financial indicators (%) | |||||

| ROE | 11.3% | 7.8% | 10.8% | 13.0% | |

| ROA | 5.0% | 5.3% | 6.3% | 4.8% | |

| Equity Ratio | 46.8% | 70.3% | 59.6% | 39.0% | |

| Per Share Indicators | |||||

| Number of shares outstanding at end of period (thousand shares) | 49,100 | 113,990 | 94,646 | 9,844 | |

| EPS (yen, Plan) | 144.12 | 187.74 | 212.37 | 609.62 | |

| BPS (yen, Act) | 1,210.96 | 2,209.32 | 1,592.79 | 5275.58 | |

| DPS (yen, Plan) | 52.00 | 76.00 | 86.00 | 190.00 | |

| Dividend payout ratio | 36.1% | 40.5% | 40.4% | 31.2% | |

| Financial data | |||||

| Net sales | 132,985 | 328,753 | 277,015 | 246,549 | |

| Five-year growth rate | 2.3% | 0.8% | 2.8% | 10.2% | |

| Gross profit | 52,240 | 127,392 | 89,005 | 42,674 | |

| Gross profit margin | 39.3% | 38.8% | 32.1% | 18.6% | |

| Operating profit | 8,523 | 23,830 | 17,372 | 8,436 | |

| Five-year growth rate | 34.7% | 5.4% | 5.7% | 23.5% | |

| Operating profit margin | 6.4% | 7.2% | 6.3% | 3.4% | |

| Net profit attributable to owners of the parent | 5,905 | 19,069 | 15,906 | 6,366 | |

| Five-year growth rate | 27.9% | 6.0% | 8.0% | 28.3% | |

| Net profit margin | 4.4% | 5.8% | 5.7% | 2.6% | |

| Number of employees at end of term | 3,892 | 6,931 | 5,492 | 3,241 | |

| Sales per Employee (thousand yen) | 34,169 | 47,432 | 50,440 | 76,072 | |

| EBITDA | 7,821 | 31,920 | 23,585 | 10,333 | |

| EBITDA margin | 8.6% | 9.7% | 8.5% | 4.2% | |

| Statements of Cash Flows | |||||

| Cash flow from operating activities | 6,321 | 34,739 | 13,491 | 7,269 | |

| Cash flow from investing activities | -4,012 | -3,798 | -6,660 | -4,857 | |

| Cash flow from financing activities | -4,148 | -14,442 | -9,485 | -3,521 | |

| Free cash flow | 2,309 | 30,941 | 6,831 | 2,412 | |

Source: Omega Investment from each company materials

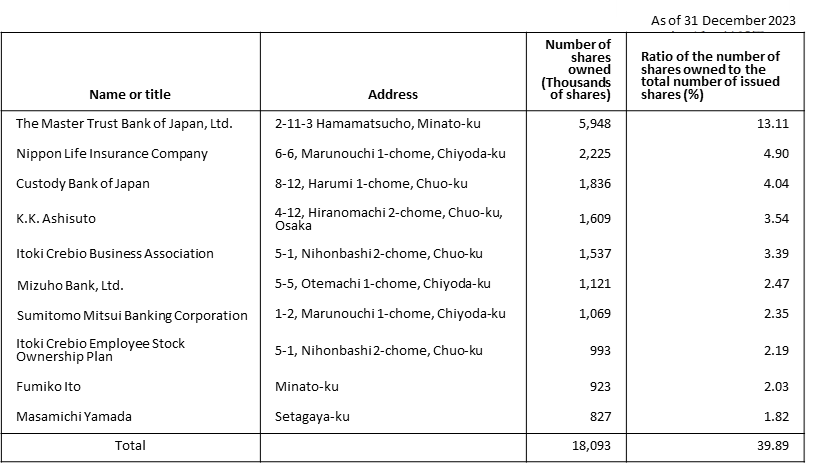

Major shareholders

Source: Annual Securities Report of the company

Shareholding by ownership

Source: Annual Securities Report of the company

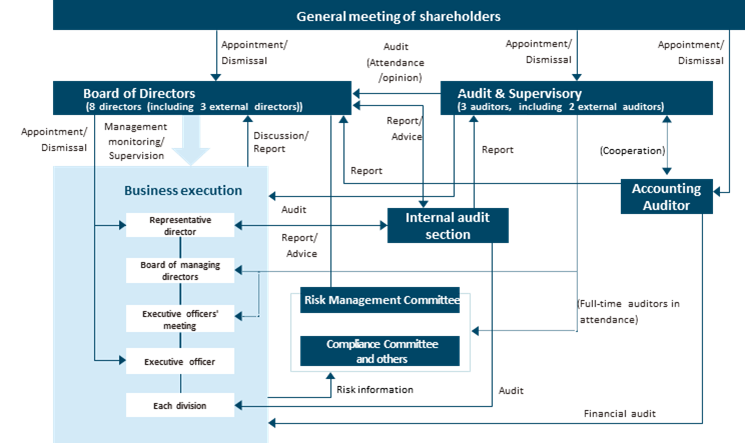

Corporate governance and top management

The company has a board of auditors with eight directors, three of whom are outside directors and designated as independent directors, one full-time auditor, and two part-time auditors (see details on the next page). The company has also adopted an executive officer system to separate management oversight from business execution.

The company has not established voluntary advisory committees, such as nomination and remuneration. However, when discussing the nomination and remuneration of senior management and directors, the committee’s chairperson actively seeks the opinion of independent outside directors and receives appropriate advice and involvement, so governance is considered to be practically functioning within the current framework.

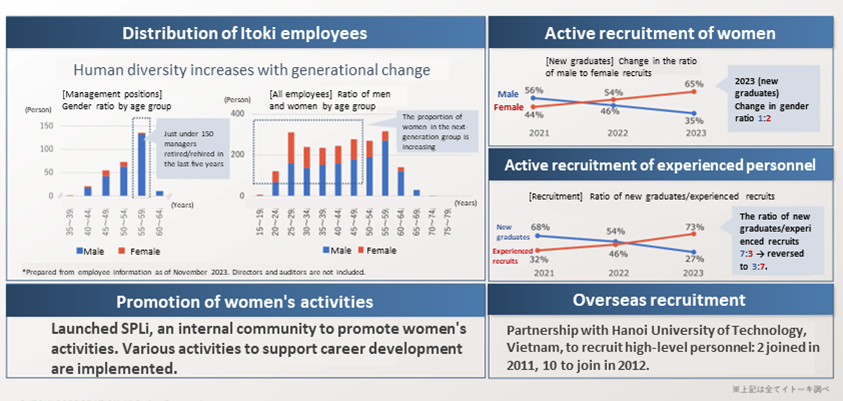

However, of the current 11 directors and auditors, 10 are male and one female (external), and all nationalities are Japanese, which means that further diversity is required.

Some progress has been made regarding employee diversity (see below).

The company’s corporate governance structure

Source: Company materials

Top management (New structure after 23 March 2023)

Chairman:Masamichi Yamada

Born in 1940

Apr. 1964 Joined The Mitsubishi Bank, Ltd. (currently MUFG Bank, Ltd.)

Jun. 1991 Director, The Mitsubishi Bank, Ltd.

Jun. 2000 Senior Managing Director, The Bank of Tokyo-Mitsubishi, Ltd.

Sep. 2002 Representative Director and Chairman, Mitsubishi Securities Co., Ltd. (currently Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.)

Jun. 2004 Full-Time Corporate Auditor, TOKYU CORPORATION

Jun. 2005 Director of the Company

Jun. 2007 Chairman of the Company (current)

President and Representative Director: Koji Minato

Born in 1970

Apr. 1994 Joined NIPPON TELEGRAPH AND TELEPHONE CORPORATION (NTT)

Jul. 2008 Joined Sun Microsystems Japan

Jun. 2010 Senior Manager for Customer Support, Oracle Corporation Japan (Business integration with Sun Microsystems)

Jun. 2015 Operating Officer, Chief of Staff, CEO Office, Oracle Corporation Japan

Aug. 2018 Corporate Executive Officer, Executive Deputy President & COO, Oracle Corporation Japan

Aug. 2019 Director, Member of the Board, Corporate Executive Officer, Executive Deputy President & COO, Oracle Corporation Japan

Sep. 2021 Joined ITOKI CORPORATION; Senior Advisor

Mar. 2022 President of the Company (current)

Director, Managing Executive Officer:Yoshiaki Moriya

Born in 1965

Apr. 1982 Joined The Dai-Ichi Kangyo Bank, Limited (currently Mizuho Bank, Ltd.)

Jul. 1988 Seconded to The Export-Import Bank of Japan (currently Japan Bank for International Cooperation)

Apr. 2007 General Manager, Personal Planning Department of Mizuho Bank, Ltd.

Jan. 2011 Joined ITOKI CORPORATION; Executive Officer and Deputy General Manager, Administration Division

Jan. 2012 Executive Officer and General Manager, Administration Division of the Company

Jan. 2015 Managing Executive Officer and General Manager, Administration Division of the Company

Mar. 2021 Director, Managing Executive Officer and General Manager, Administration Division of the Company (current)

Director:Naoki Kaze

Born in 1962

Apr. 1986 Joined the former ITOKI Co., Ltd. (“former ITOKI”)

Jan. 2007 General Manager, Tokyo-Nishi Branch of the Company

Jan. 2010 General Manager, Tokyo-Nishi Branch Office of the Company

Jan. 2013 Executive Officer and General Manager, Tokyo-Nishi Branch Office of the Company

Jan. 2016 Executive Officer and General Manager, Tokyo Branch Office of the Company

Jan. 2018 Executive Officer and General Manager, Knoll Business Management Department of the Company and President, Knoll Japan Inc.

Jan. 2021 Managing Executive Officer and General Manager, Sales Division of the Company (current)

Director:Junsei Shinada

Born in 1961

Apr. 1985 Joined the former ITOKI Co., Ltd. (“former ITOKI”)

Jul. 2006 General Manager, Minato Branch, Tokyo-Higashi Sales Department of the Company

Jan. 2014 General Manager, Higashi-Nihon Branch Office of the Company

Jan. 2016 Executive Officer and General Manager, Corporate Customer Sales Management Department of the Company

Jan. 2018 Executive Officer and General Manager, Corporate Customer Sales Management Department, and General Manager, Customer Value Management Department of the Company

Jul. 2021 Executive Officer and General Manager, Engineering Management Department of the Company

Jan. 2023 Managing Executive Officer and General Manager, Planning Division of the Company (current)

Director (outside director): Hiroshi Nagata

Born in 1941

Apr. 1970 Joined MITSUI & CO., France

Jun. 1996 Director, MITSUI & CO., LTD. (“MITSUI”)

Jun. 1999 Managing Director, MITSUI President, MITSUI & CO. EUROPE PLC

Apr. 2002 Representative Director, Executive Vice President and Chemicals Group President, MITSUI

Apr. 2005 Visiting Professor at Waseda University Graduate School of Commerce (MBA Course)

Mar. 2008 External Director of the Company (current)

Oct. 2018 President and Representative Director, CLEA Holdings Co., Ltd. (current)

Dec. 2021 Outside Director, CLEA Japan, Inc. (current)

Director (outside director): Shiro Nitanai

Born in 1958

Apr. 1984 Joined The Ministry of Posts and Telecommunications

Apr. 2005 General Manager, Businesses Development Department, Corporate Planning Division, Japan Post (currently Japan Post Holdings Co., Ltd.)

Oct. 2009 General Manager, Real Estate Planning Department, Real Estate Division, Japan Post Holdings Co., Ltd.

May 2019 Representative, Facility Design Lab (current)

Visiting professor, University of Tsukuba (current)

Adjunct Instructor, Toyo University (current)

Mar. 2020 External Director of the Company (current)

Director (outside director): Mariko Bando

Born in 1946

Jul. 1969 Entered the Prime Minister’s Office

Jul. 1989 Director, Consumer Statistics Division, Statistics Bureau of the Management and Coordination Agency

Apr. 1995 Vice-Governor, Saitama Prefecture

Jun. 1998 Consul General of Japan in Brisbane, Australia

Jan. 2001 Director General, Gender Equality Bureau, Cabinet Office

Oct. 2003 Member, The Board of Trustees, Showa Women’s University

Jul. 2016 Chancellor (Socho), Showa Women’s University (current)

Jun. 2017 Outside Director, MS&AD Insurance Group Holdings, Inc. (current)

Dec. 2019 Outside Director, Mitsubishi Research Institute, Inc. (current)

Auditor (full-time auditor): Eiji Funahara

Apr. 1982 Joined Itoki Kosakusho Co., Ltd. (currently ITOKI CORPORATION)

Jun. 2005 General Manager, Facilities Equipment Engineering Department of the Company)

Jan. 2015 Executive Officer and General Manager, Production Department Group, Production Division of the Company

Jan. 2020 Managing Executive Officer and General Manager, Production Division, General Manager, Quality Assurance Division, and General Manager, Production Department Group of the Company

Mar. 2020 Director, Managing Executive Officer, General Manager, Production Division, General Manager, Quality Assurance Division, and General Manager, Production Department Group of the Company

Mar. 2024 Full-Time Audit & Supervisory Board member of the Company (current)

Auditor (outside auditor):Osamu Ishihara

Born in 1960

Apr. 1987 Registered as Attorney-at-law in Tokyo Bar Association Joined Nishimura and Sanada

Oct. 1990 Joined TMI Associates

Apr. 1997 Partner, TMI Associates (current)

Mar. 2010 External Auditor, Odawara Engineering Co., Ltd. (current)

Apri.2012 Executive Governor, Japan Federation of Bar Associations Vice-President, Tokyo Bar Association

Apr. 2015 Vice-President, Kanto Federation of Bar Associations

Auditor (Outside auditor):Hisashi Shirahata

Born in 1962

Sep. 1985 Joined Aoyama Audit Corporation

Jul. 1988 Registered as Certified Public Accountant

Jul. 1999 Joined Aoyama Audit Corporation

Jul. 2000 Admitted as Partner (Shain) of ChuoAoyama Audit Corporation

Jul. 2002 Representative Partner (Daihyo-Shain) of ChuoAoyama Audit Corporation

Sep. 2006 Representative Partner (Daihyo-Shain) of PwC Aarata (currently PricewaterhouseCoopers Aarata LLC)

Jul. 2022 Outside Director, Information Development Co., Ltd. (current)

Source: Company materials

Skills matrix of the Board of Directors’ Members

Source: Company materials

Sustainability

As the company is a manufacturing company, CO2 emissions are inevitable in office furniture and logistics equipment production. Therefore, the company is highly aware of the SDGs and ESGs and has prepared an integrated report since 2021. In addition, the ESGDATA BOOK was published in 2022. It details the company’s evaluation of its materiality, KPI performance and other information.

Particularly noteworthy is that it has developed a medium-term environmental plan regarding the environment, which communicates concrete and quantitative progress for each year. For greenhouse gas emissions, the plan sets out reduction targets not only for Scope 1 and 2 but also for Scope 3. Besides CO2 emissions, the plan also includes quantitative analyses of the introduction of renewable energy, carbon offsets, biodiversity, environmental accounting, etc.

About the SDGs, the following materialities have been defined. As noted before, there is scope for improvement in terms of diversity, but as per corporate governance, risk management and compliance systems are in place.

The company’s approach to materiality

Source: Company materials

In addition, the employee diversity initiatives mentioned earlier are as follows and show steady progress.

Source: Company materials

Financial data (quarterly basis)

FY (¥mn) |

2020/12 | 2021/12 | 2022/12 | 2023/12 | ||||||||||||

| 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | |

| [Statements of income] | ||||||||||||||||

| Net sales | 37,707 | 26,997 | 21,489 | 30,017 | 32,167 | 29,468 | 22,412 | 31,858 | 35,345 | 28,411 | 26,205 | 33,363 | 36,965 | 31,225 | 28,667 | 36,128 |

| Year-on-year basis (%) | 11.2 | -9.3 | -24.5 | -0.1 | -14.7 | 9.2 | 4.3 | 6.1 | 9.9 | -3.6 | 16.9 | 4.7 | 4.6 | 9.9 | 9.4 | 8.3 |

| Cost of sales | 23,710 | 17,765 | 13,811 | 19,036 | 20,101 | 18,729 | 14,443 | 20,872 | 21,483 | 18,030 | 16,678 | 21,384 | 22,216 | 18,954 | 17,483 | 22,091 |

| Gross profit | 13,997 | 9,232 | 7,678 | 10,981 | 12,020 | 10,722 | 7,953 | 10,999 | 13,862 | 10,381 | 9,527 | 11,979 | 14,748 | 12,271 | 11,184 | 14,037 |

| SG&A expenses | 10,996 | 9,602 | 9,590 | 9,901 | 10,352 | 9,453 | 9,203 | 10,150 | 9,898 | 9,973 | 9,812 | 11,484 | 9,970 | 10,047 | 11,006 | 12,694 |

| Operating income | 3,001 | -370 | -1,912 | 1,079 | 1,698 | 1,275 | -1,242 | 829 | 3,964 | 407 | -285 | 496 | 4,777 | 2,225 | 177 | 1,344 |

| Year-on-year basis (%) | 43.5 | – | – | – | -43.4 | – | – | -23.2 | 133.4 | -68.7 | – | -40.2 | 20.5 | 446.7 | – | 171.0 |

| Operating profit ratio (%) | 8.0 | -1.4 | -8.9 | 3.6 | 5.3 | 4.3 | -5.5 | 2.6 | 11.2 | 1.4 | -1.1 | 1.5 | 12.9 | 7.1 | 0.8 | 3.7 |

| Non-operating income | 154 | 162 | 251 | 237 | 240 | 161 | 171 | 122 | 125 | 164 | 171 | 96 | 125 | 114 | 141 | 101 |

| Non-operating expenses | 273 | 168 | 107 | 172 | 250 | 257 | 101 | 185 | 115 | 130 | 177 | 539 | 79 | 68 | 52 | 249 |

| Ordinary income | 2,882 | -376 | -1,768 | 1,143 | 1,657 | 1,173 | -1,179 | 786 | 3,974 | 442 | -291 | 52 | 4,824 | 2,271 | 265 | 1,195 |

| Extraordinary income | 0 | 6 | 125 | 980 | 1,255 | 78 | 133 | 88 | 786 | 139 | 118 | 6,762 | 1 | 15 | 120 | 50 |

| Extraordinary expenses | 116 | 42 | 55 | 1,503 | 20 | 456 | 518 | 1,474 | 44 | 64 | 38 | 3,465 | 21 | 10 | 24 | 308 |

| Income before income taxes | 2,766 | -412 | -1,697 | 620 | 2,893 | 795 | -1,565 | -600 | 4,716 | 516 | -211 | 3,351 | 4,804 | 2,275 | 363 | 936 |

| Total income taxes | 1,039 | 134 | -195 | 654 | 1,028 | 490 | -132 | -796 | 1,381 | 246 | -21 | 1,585 | 1,506 | 864 | 161 | -60 |

| Net income | 1,760 | -557 | -1,491 | 53 | 1,942 | 348 | -1,440 | 316 | 3,388 | 288 | -159 | 1,777 | 3,296 | 1,411 | 202 | 996 |

| Year-on-year basis (%) | 43.6 | – | – | – | 10 | – | – | 496.2 | 74.4 | -17.2 | – | 462.3 | -2.7 | 389.9 | – | -44.0 |

| Net income ratio (%) | 4.7 | -2.1 | -6.9 | 0.2 | 6.0 | 1.2 | -6.4 | 1.0 | 9.6 | 1.0 | -0.6 | 5.3 | 8.9 | 4.5 | 0.7 | 2.8 |

| [Balance Sheets] | ||||||||||||||||

| Current assets | 69,811 | 60,382 | 52,463 | 57,183 | 65,543 | 62,170 | 55,249 | 57,753 | 69,458 | 64,096 | 59,873 | 71,027 | 72,230 | 68,755 | 68,040 | 73,304 |

| Cash and deposits | 18,186 | 21,312 | 18,956 | 18,246 | 19,503 | 22,112 | 18,213 | 17,351 | 19,196 | 20,073 | 17,138 | 26,876 | 20,898 | 24,688 | 23,192 | 24,795 |

| Notes and accounts receivable – trade | 37,611 | 27,230 | 20,298 | 26,599 | 32,061 | 26,596 | 21,385 | 26,783 | – | – | – | – | – | – | – | |

| Notes and accounts receivable – trade, and contract assets | – | – | – | – | – | – | – | – | 35,205 | 28,234 | 24,111 | 29,316 | 34,519 | 28,377 | 26,948 | 31,158 |

| Non-current assets | 49,872 | 49,933 | 50,410 | 47,912 | 46,925 | 46,369 | 46,046 | 46,144 | 46,647 | 47,395 | 48,126 | 44,260 | 43,611 | 42,918 | 43,533 | 44,132 |

| Property, plant and equipment | 27,612 | 27,350 | 27,329 | 26,206 | 25,184 | 24,779 | 24,887 | 24,417 | 25,105 | 26,042 | 26,932 | 24,978 | 24,689 | 24,952 | 24,730 | 24,792 |

| Intangible assets | 5,113 | 5,623 | 5,853 | 5,590 | 5,504 | 5,419 | 4,885 | 4,114 | 4,128 | 4,168 | 4,145 | 1,819 | 1,837 | 1,884 | 2,161 | 2,292 |

| Goodwill | 2,391 | 2,207 | 2,189 | 2,093 | 2,018 | 2,016 | 1,407 | 1,317 | 1,214 | 1,222 | 1,200 | 517 | 446 | 391 | 346 | 341 |

| Investments and other assets | 17,146 | 16,959 | 17,227 | 16,116 | 16,236 | 16,170 | 16,273 | 17,612 | 17,413 | 17,184 | 17,048 | 17,462 | 17,084 | 16,080 | 16,641 | 17,048 |

| Total assets | 120,352 | 110,940 | 103,453 | 105,096 | 112,469 | 108,540 | 101,295 | 103,898 | 116,105 | 111,492 | 108,000 | 115,288 | 115,841 | 111,693 | 111,573 | 117,437 |

| Current liabilities | 55,449 | 46,097 | 40,198 | 43,646 | 49,245 | 45,266 | 40,307 | 42,544 | 51,837 | 47,138 | 43,655 | 49,099 | 47,854 | 42,547 | 42,010 | 47,340 |

| Short-term borrowings | 15,616 | 13,289 | 14,239 | 13,234 | 13,458 | 12,061 | 12,409 | 12,500 | 15,014 | 11,976 | 11,738 | 11,239 | 10,874 | 10,299 | 10,383 | 10,276 |

| Non-current liabilities | 18,327 | 18,220 | 18,079 | 17,259 | 17,506 | 17,088 | 16,257 | 16,277 | 16,334 | 16,020 | 16,178 | 16,278 | 16,238 | 15,727 | 15,724 | 15,096 |

| Long-term borrowings | 9,475 | 9,574 | 9,453 | 8,508 | 8,711 | 8,193 | 7,435 | 7,591 | 7,427 | 7,174 | 7,266 | 7,530 | 7,453 | 7,062 | 6,959 | 6,577 |

| Total liabilities | 73,777 | 64,318 | 58,277 | 60,906 | 66,751 | 62,354 | 56,565 | 58,822 | 68,172 | 63,158 | 59,833 | 65,377 | 64,092 | 58,275 | 57,734 | 62,437 |

| Total net assets | 46,575 | 46,621 | 45,175 | 44,189 | 45,717 | 46,186 | 44,730 | 45,076 | 47,933 | 48,333 | 48,166 | 49,910 | 51,748 | 53,418 | 53,839 | 54,999 |

| Shareholders’ equity | 45,479 | 45,390 | 43,786 | 43,691 | 45,047 | 45,419 | 43,979 | 44,301 | 47,249 | 47,567 | 47,408 | 49,185 | 50,806 | 52,267 | 52,469 | 54,960 |

| Share capital | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 | 5,294 |

| Capital surplus | 9,201 | 9,642 | 9,641 | 9,628 | 9,628 | 9,632 | 9,632 | 9,638 | 9,638 | 9,638 | 9,638 | 9,638 | 9,638 | 9,665 | 9,665 | 9,665 |

| Retained earnings | 31,030 | 30,461 | 28,884 | 28,950 | 30,306 | 30,654 | 29,213 | 29,530 | 32,477 | 32,769 | 32,610 | 34,387 | 36,008 | 37,419 | 37,621 | 38,617 |

| Treasury shares | -46 | -6 | -33 | -182 | -182 | -161 | -161 | -161 | -161 | -134 | -134 | -134 | -314 | -111 | -111 | -111 |

| Share acquisition rights | 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 | ||

| Total liabilities and net assets | 120,352 | 110,940 | 103,453 | 105,096 | 112,469 | 108,540 | 101,295 | 103,898 | 116,105 | 111,492 | 108,000 | 115,288 | 115,841 | 111,693 | 111,573 | 117,437 |

| [Statements of cash flows] | ||||||||||||||||

| Cash flow from operating activities | 5,404 | -843 | 4,577 | -1,803 | 4,581 | 1,223 | 4,078 | 2,243 | ||||||||

| Cash flow from investing activities | -1,442 | 290 | 503 | -1,673 | -1,410 | 6,333 | -3,265 | -747 | ||||||||

| Cash flow from financing activities | 293 | -2,560 | -1,418 | -1,240 | -661 | -765 | -3,266 | -882 | ||||||||

| Free cash flow | 3,962 | -553 | 5,080 | -3,476 | 3,171 | 7,556 | 813 | 1,496 | ||||||||

| Net increase in cash and cash equiv. | 4,240 | -3,037 | 3,787 | -4,687 | 2,630 | 6,911 | -2,466 | 711 | ||||||||

| Cash and cash equiv. at beginning of period | 15,494 | 19,735 | 16,697 | 20,485 | 15,797 | 18,509 | 25,420 | 22,953 | ||||||||

| Cash and cash equiv. at end of period | 19,735 | 16,697 | 20,485 | 15,797 | 18,509 | 25,420 | 22,953 | 23,664 | ||||||||

Source: Omega Investment from company materials

Financial data (full-year basis)

FY (¥mn) |

FY12/2013 |

FY12/2014 |

FY12/2015 |

FY12/2016 |

FY12/2017 |

FY12/2018 |

FY12/2019 |

FY12/2020 |

FY12/2021 |

FY12/2022 |

FY12/2023 |

[Statements of income] |

|||||||||||

Net sales |

103,461 |

102,993 |

106,516 |

101,684 |

108,684 |

118,700 |

122,174 |

116,210 |

115,839 |

123,324 |

132,985 |

Year-on-year basis (%) |

-1.9 |

-0.5 |

3.4 |

-4.5 |

6.9 |

9.2 |

2.9 |

-4.9 |

-0.3 |

6.4 |

7.8 |

Cost of sales |

67,118 |

66,797 |

68,374 |

65,021 |

69,966 |

77,436 |

80,495 |

74,322 |

74,145 |

77,575 |

80,744 |

Gross profit |

36,343 |

36,196 |

38,142 |

36,663 |

38,718 |

41,264 |

41,679 |

41,888 |

41,694 |

45,749 |

52,240 |

Gross profit ratio (%) |

35.1 |

35.1 |

35.8 |

36.1 |

35.6 |

34.8 |

34.1 |

36.0 |

36.0 |

37.1 |

39.3 |

SG&A expenses |

32,203 |

33,723 |

33,836 |

33,862 |

35,761 |

39,339 |

40,776 |

40,089 |

39,158 |

41,167 |

43,717 |

Operating income |

4,140 |

2,472 |

4,306 |

2,800 |

2,956 |

1,925 |

903 |

1,798 |

2,536 |

4,582 |

8,523 |

Operating profit ratio (%) |

4.0 |

2.4 |

4.0 |

2.8 |

2.7 |

1.6 |

0.7 |

1.5 |

2.2 |

3.7 |

6.4 |

Non-operating income |

813 |

841 |

898 |

771 |

750 |

889 |

677 |

804 |

694 |

556 |

481 |

Non-operating expenses |

528 |

495 |

605 |

483 |

412 |

448 |

634 |

720 |

793 |

961 |

448 |

Ordinary income |

4,425 |

2,818 |

4,599 |

3,087 |

3,295 |

2,365 |

945 |

1,881 |

2,437 |

4,177 |

8,555 |

Extraordinary income |

685 |

615 |

171 |

97 |

228 |

919 |

27 |

1,111 |

1,554 |

7,805 |

186 |

Extraordinary expenses |

238 |

262 |

524 |

267 |

121 |

204 |

35 |

1,716 |

2,468 |

3,611 |

363 |

Income before income taxes |

4,872 |

3,171 |

4,246 |

2,918 |

3,401 |

3,081 |

938 |

1,277 |

1,523 |

8,372 |

8,378 |

Total income taxes |

876 |

813 |

-385 |

1,068 |

959 |

1,339 |

1,517 |

1,632 |

590 |

3,191 |

2,471 |

Net income |

3,910 |

2,160 |

4,530 |

1,907 |

2,402 |

1,722 |

-550 |

-235 |

1,166 |

5,294 |

5,905 |

Net income ratio (%) |

3.8 |

2.1 |

4.3 |

1.9 |

2.2 |

1.5 |

-0.5 |

-0.2 |

1.0 |

4.3 |

4.4 |

ROE(%) |

10.2 |

5.2 |

10.4 |

4.2 |

5.2 |

3.7 |

-1.2 |

-0.5 |

2.6 |

11.1 |

11.3 |

[Balance Sheets] |

|||||||||||

Current assets |

52,925 |

55,714 |

56,342 |

52,410 |

58,147 |

62,143 |

58,109 |

57,183 |

57,753 |

71,027 |

73,304 |

Cash and deposits |

19,553 |

21,211 |

21,456 |

19,839 |

19,977 |

16,229 |

17,030 |

18,246 |

17,351 |

26,876 |

24,795 |

Notes and accounts receivable – trade |

26,243 |

25,965 |

26,138 |

23,241 |

26,869 |

33,160 |

28,244 |

26,599 |

26,783 |

||

Notes and accounts receivable – trade, and contract assets |

29,316 |

31,158 |

|||||||||

Non-current assets |

42,335 |

41,007 |

41,832 |

43,271 |

44,073 |

46,559 |

49,955 |

47,912 |

46,144 |

44,260 |

44,132 |

Property, plant and equipment |

28,193 |

27,041 |

26,395 |

25,322 |

24,426 |

26,362 |