Keiwa (Price Discovery)

No strong view

Profile

Develops and manufactures high-performance films for LCDs. Also involved in packaging materials for steel and construction materials. Established in 1948 by Hidetaro Nagamura. Sales mix % (OPM %): Optical Sheets 76 (42), Living & Environmental Innovation 23 (8), Plasters of the Earth 1 (-329) – FY12/2023

| Securities Code |

| TYO:4251 |

| Market Capitalization |

| 29,313 million yen |

| Industry |

| Chemistry |

Stock Hunter’s View

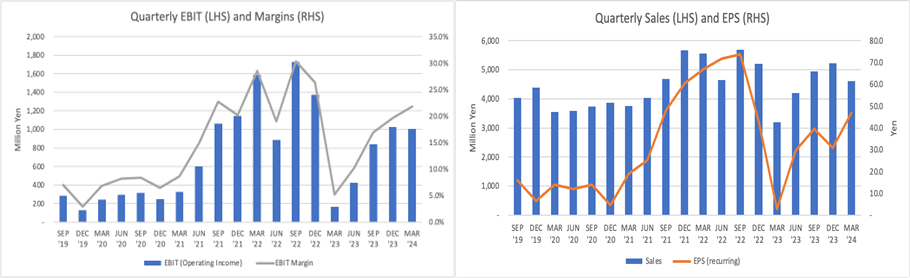

Keiwa’s profitability is upward, marking a strong start to FY12/2024.

Keiwa’s earnings recovery is evident. The company develops and sells light diffusion films used in notebook PCs, tablets, and other displays, high-value-added optical sheets for in-vehicle displays and VR equipment. Its strategy targets niche fields and launches high-value-added products to secure a high global market share.

Keiwa’s financial results for the first quarter of FY12/2024, announced on May 14, are impressive. The company recorded net sales of 4,609 million yen (up 44.1% YoY) and operating profit of 1,003 million yen (six times YoY), indicating a significant recovery from the previous year’s performance.

The growth driver “OPASUKI,” a composite diffusion plate for LED LCDs, saw mass production shipments for several projects and received new orders. In addition to increased demand for OPALUS, a conventional light diffusion film, existing customers increased their market share due to the market recovery, and mass production and shipments for several projects progressed. New products with special functions for new models performed well in the smartphone market.

In addition, the ratio of other highly profitable products, such as speciality film products for clean energy vehicles and films for medical hygiene applications, increased. The company has decided to add a manufacturing facility for medical hygiene products to accommodate further orders.

Investor’s View

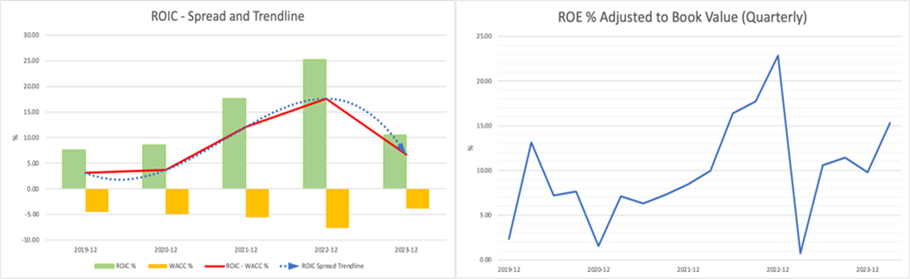

No strong view. Valuations are fairly cheap, but the earnings are difficult to forecast. The underlying ROE is declining due to worsening leverage. Investors should view the shares cautiously.

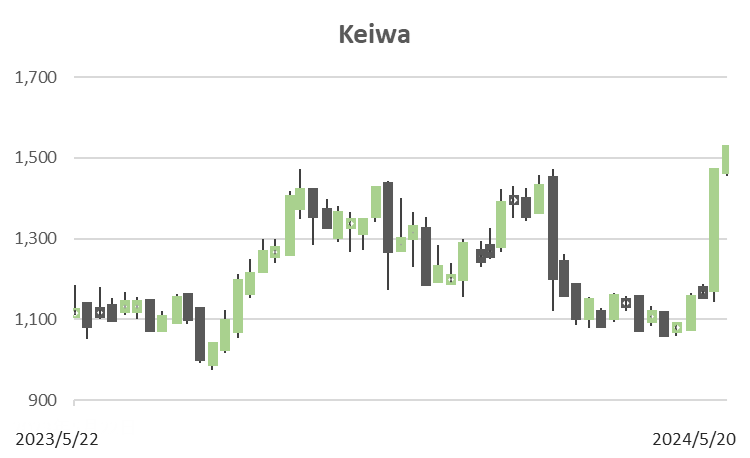

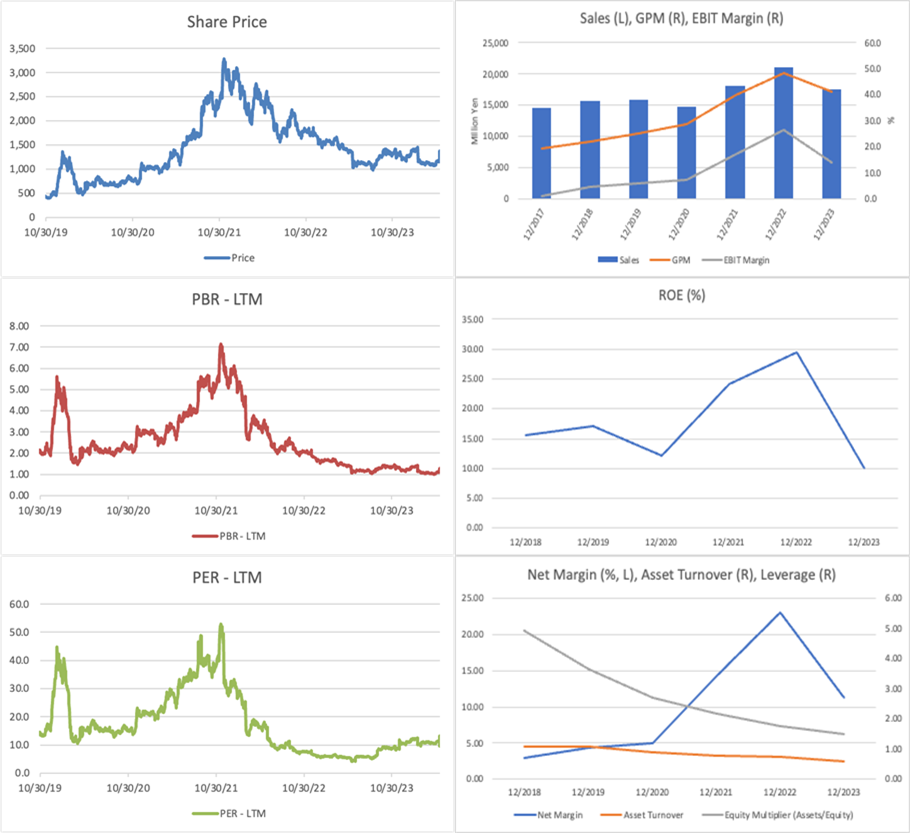

The shares of a company with a recent ROE of 10% are trading on 10x earnings and 1.3x book. The current equity yield is as high as 15%. In the four and a half years since the IPO, the stock has beaten TOPIX only once. This was when the share price doubled in 2021, immediately after listing. The stock price has risen 10% since the beginning of the year but is an underperformer versus TOPIX.

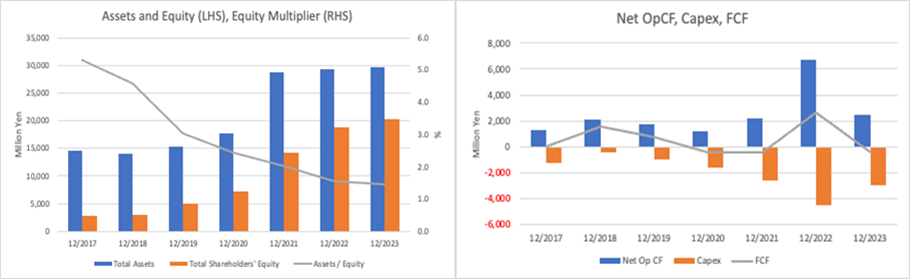

ROE is very volatile, but the underlying ROE is declining. The background is puzzling. This is probably the reason why the stock price has been lacklustre despite the recovery in profit momentum. The records indicate the leading cause is the sharp decline in the Equity Multiplier. As a result, the company’s fairly good ROA has not been leveraged. Management should have controlled the increase in equity by increasing shareholder returns. However, being capital-intensive as a manufacturer of high-performance products and driven by short-term investments, the company would not consider a short-term shareholder-oriented financial policy.

From a PER perspective, we are confident that the company’s earnings are cyclical and that momentum will increase rapidly as the smartphone and tablet markets recover. On the other hand, we need a more confident view of the medium- to long-term competitiveness of the company’s products from the IR presentation. Product prices reflect performance competition, and predicting the profit margins over a particular business cycle is difficult. We do not have an answer if we are asked whether the company is a cyclical growth. Many LCD-related stocks are in the stock market, and we do not see any reason to rate the company particularly well.

As a niche company with a long history, Keiwa’s management team has earned a reputation for its sincerity and strategic thinking. The potential for the company to regain a high ROE by carefully considering the stock price and cost of capital presents an intriguing investment opportunity. Depending on the business cycle and the company’s strategic moves, we would consider investing in Keiwa at the first sign of such a move, underscoring the potential for growth and profitability.